US stocks clawed back some of its losses last week, after nosediving the week before. Markets were supported by the Federal Reserve’s announcement on Monday around its plans to begin buying individual corporate bonds in addition to the ETFs already being purchased.

The latest move by the Fed comes a week after the FOMC (Federal Open Market Committee) issued a dismal outlook for the US economy due to the pandemic. While the bears were on the prowl due to a rise in coronavirus cases in various states of the US and a new outbreak in Beijing, bulls pushed US stocks to the green zone with a broad-based rise versus the previous obsession with tech giants.

Sentiment was helped by initial jobless claims easing to 1.51 million in the latest week, from a revised reading of 1.57 million in the prior week, as well as optimism around the inking of a US-China trade deal.

Performance of US Indices

Although US stocks gave up earlier advances to finish mostly lower on Friday, they were able to end the week with gains.

After declining around 5.5% in the previous week, the Dow Jones Industrial Average rose 1% last week to settle at 25,871.46. The S&P 500 index slipped 17.60 points on Friday but managed to close the week higher by 1.9%. The Nasdaq Composite Index was the top performer last week, rising 3.7% to close the week at 9,946.12, after having breached the 10,000 mark again.

Top US Stocks of the Week

JinkoSolar Holding Co’s (NYSE: JKS) shares plummeted around 9% on Monday after the China-based company reported downbeat Q1 earnings. The company’s stock lost over 10% last week.

On Wednesday, shares of Groupon Inc (NASDAQ: GRPN) shares plunged 21% after the company posted a 35% decline in sales. Shares of the Chicago, Illinois-based company ended the week down by 0.7%.

Oracle Corporation’s (NYSE: ORCL) shares declined by 5% on Wednesday after the company reported weaker-than-expected quarterly sales. Despite the downturn, the stocked ended the week higher by 5%.

On Thursday, Kroger Co’s (NYSE: KR) shares lost 3% despite the company reporting better-than-expected quarterly results. The stock remained unchanged for the week.

ABM Industries Incorporated’s (NYSE: ABM) shares gained around 20% on Thursday after the company reported stronger-than-expected Q2 results. The stock added 21% for the week.

Performance of European Indices

European stocks regained some lost momentum and closed higher on Friday. Markets inched up to record weekly gains, following the previous performance of being the worst week since March 13. Despite worries over rising covid-19 cases in various parts of the world, hopes of the US-China trade war ending injected some bullishness in the markets. Sentiment also turned more positive as leaders of the European Union relaunched their negotiations on Friday related to a €750 billion recovery fund to support economies suffering from coronavirus crisis.

The Stoxx Europe 600 index rose 0.6% on Friday and closed the week higher by 3.2%, after declining 5.7% in the previous week. The FTSE 100 gained 1.1% on Friday, adding 3.1% for the week. The German DAX 30 and French CAC 40 posted weekly gains of 3.2% and 2.9%, respectively.

Top European Stocks of the Week

Shares of SSE climbed more than 9% on Wednesday after the UK-based company reported a sharp decline in pretax profits.

Shares of Colruyt dropped over 5% after the Belgian retailer reported downbeat sales growth for the fiscal year.

Siemens Gamesa Renewable Energy’s stock slipped 8% on Thursday, after the company announced the resignation of its CEO and projected operating losses for the third quarter.

The Forex Market

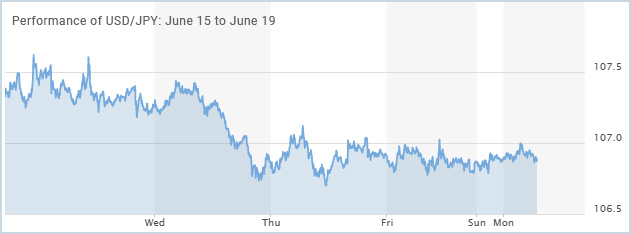

The US dollar slipped versus the Japanese yen during the week, although the pair remained range bound. Bank of Japan’s meeting minutes indicated hawkish views of policymakers for the country’s economy. The greenback drifted lower towards the ¥106.50 level, but settled at ¥106.87, posting a loss of around 0.5% for the week.

The British pound struggled to rise during the week but gave up gains after the Bank of England announced plans to expand its bond-buying by £100 billion. The UK also reported a strong 12% upturn in retail sales in May, after an 18% decline in the previous month. The pound closed Friday’s trading mostly unchanged versus the US dollar but was down 1.5% on last week.

The Crypto Market

Last week was eventful for Bitcoin, with its price plunging to $8,900 at one point. The cryptocurrency recovered a little to close the week down around 5%.

Image: Performance of Bitcoin: June 15 to June 19

Image: Performance of Bitcoin: June 15 to June 19

Bitcoin is currently regarded as a safe-haven option, with stock and commodity markets under pressure due to prospects of a second wave of coronavirus infections.

Leave A Comment

You must be logged in to post a comment.