US markets ended at their lowest level in around two weeks on Friday, with concerns around the record rise in new infections. Wall Street was looking to extend the previous week’s rally, but failed to build on gains as various states in the US continued reporting a rise in daily cases, forcing Texas and Florida to roll back their reopening efforts.

US reported over 37,000 infections on Thursday, representing the highest single-day rise. Texas recorded 6,426 new cases on Thursday, while Florida reporting more than 8,900 infections.

Markets were also pressurized by the Federal Reserve’s annual bank stress test results, requiring banks to suspend share buybacks and limit dividends during the third quarter. The only silver lining came in the form of positive economic reports, which continued to indicate a recovery in economic activity in the US. Initial jobless claims eased to 1.48 million in the latest week.

Performance of US Indices

US stocks fell sharply on Friday to end the week lower, following a spike in coronavirus cases and results from the Federal Reserve’s annual bank stress tests.

After rising 1% the week before, the Dow Jones Industrial Average lost 3.3% last week to settle at 25,015 on Friday. The index shed 730 points on Friday. The S&P 500 index plummeted 2.4% on Friday, closing the week lower by 2.9%. The Nasdaq Composite Index surged to a new record high during the week, but closed the week down by 1.9% at 9,757.

Top US Stocks of the Week

Shares of American Airlines (NASDAQ: AAL) plunged around 7% on Monday after the airline company announced a stock and convertible note offering worth $3.5 billion. The company’s shares lost more than 22% last week.

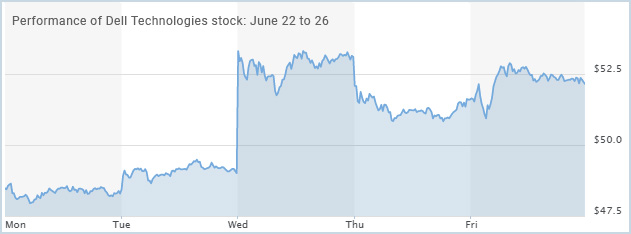

On Wednesday, Dell Technologies Inc’s (NYSE: DELL) shares climbed over 8% following a report of the company seeking to divest its majority stake in VMware, Inc. (NYSE: VMW). Shares of the Round Rock, Texas-based company gained around 7% for the week.

Rite Aid Corporation’s (NYSE: RAD) shares spiked around 27% on Thursday, after the company reported better-than-expected quarterly results. The stock added around 22% during the week.

On Thursday, shares of FactSet Research Systems Inc. (NYSE: FDS) rose by 15% after reporting stronger-than-expected Q3 earnings and providing an upbeat earnings forecast for fiscal 2021. FactSet’s shares gained more than 8% last week.

Shares of KB Home (NYSE: KBH) dipped around 12% on Thursday, after the company’s quarterly sales missed estimates. However, the Los Angeles, California-based company posted upbeat Q2 profits. KB Home’s shares lost more than 11% last week.

Shares of Nike, Inc. (NYSE: NKE) dropped around 8% on Friday, after the athletic footwear giant reported weaker-than-expected Q4 results. The stock lost around 2% during the week.

Performance of European Indices

European stocks closed lower on Friday after posting strong gains earlier in the session, as Wall Street recorded a sharp decline due to a rise in covid-19 cases. The global equity markets swung between gains and losses last week, amid optimism over an improvement in European economic data and fears of a second wave of infections prompting the reinforcement of restrictions.

The ECB also announced a Eurosystem repo facility (EUREP) for central banks to address liquidity issues outside the Eurozone.

The Stoxx Europe 600 Index slipped 0.4% on Friday, closing the week lower by 2% after posting gains in the previous week. The London’s FTSE 100 rose 0.2% on Friday, but shed 2.1% last week. The German DAX 30 and French CAC 40 indices lost 2% and 1.4%, respectively, for the week.

Top European Stocks of the Week

Shares of Glencore dipped to a three-week low on Monday after the Swiss authorities started a criminal investigation against the company.

Carnival PLC’s shares tumbled about 10% after the company announced plans to extend its pause in operations in North America.

Shares of Capita PLC jumped 13% after the company announced plans to sell its education software solutions (ESS) unit.

Aegon’s shares gained 9% on Tuesday, after naming Dutch insurer Duncan Russell as its Chief Transformation Officer (CTO).

Kloeckner & Co’s shares gained 17% after the German company provided a positive earnings outlook for the second quarter.

The Forex Market

The Canadian dollar tumbled to a four-week low against the greenback on Friday as investors worried about the resurgence of coronavirus cases in the US putting breaks on reopening efforts. The US is a major market for Canada, as it exports around 75% of its products to America. The USD/CAD settled at $1.369 on Friday, with the loonie losing 0.6% last week versus the greenback.

The euro edged higher against the US dollar on Friday. The central banks of both regions continued to make announcements to lend support to their financial markets. The euro added around 0.4% versus the greenback last week.

The Crypto Market

Bitcoin sold off sharply on Thursday, tumbling from $9,650 to $8,990 and failed to record significant gains on Friday, trading between $9,000 and $9,200.

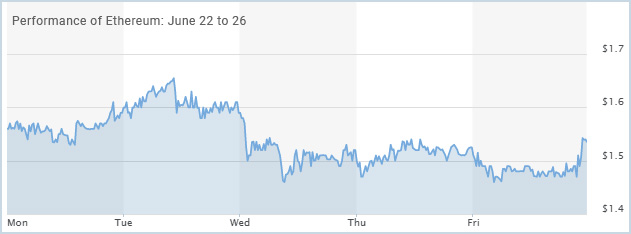

Ethereum exhibited positive momentum on Monday and Tuesday, only to decline sharply on Wednesday and continue to fall through the week. The digital currency, which seemed on track to breaching the $290 mark, traded below $230 through the weekend.

Leave A Comment

You must be logged in to post a comment.