US markets started the week on a positive note despite a spike in new coronavirus cases. Various states in the US, including Texas and Florida, have reversed their reopening measures after witnessing a record rise in cases last week, including the highest single-day infections of 52,000 on Wednesday.

Investors cheered news of Pfizer and German firm BioNTech reporting encouraging early trial data from their coronavirus vaccine study. Markets lost some of the momentum after news of a delay in Moderna’s final-stage trial for its covid-19 vaccine candidate.

With people returning to work since the reopening of various states in the US, economic activity in the country witnessed a significant improvement. The NFP report showed the addition of 4.8 million jobs in June, exceeding estimates of 3.7 million. The country’s unemployment rate dipped to 11.1% in June. Initial jobless claims also continued to ease in the latest week, with the number falling to 1.43 million in the seven days ended June 27, compared to 1.48 million in the earlier week.

Performance of US Indices

US stocks closed higher on Thursday to end the holiday-shortened week on a strong note following the better-than-expected jobs report.

The Dow Jones Industrial Average climbed 3.3% last week, after losing 3.3% in the prior week. The index closed well off its session intraday at 25,827.36 on Thursday, booking a rise of 92.39 points. After rising 0.5% on Thursday, the S&P 500 index closed the week higher by 4%. The Nasdaq Composite Index recorded its second consecutive record close on Thursday, but the settlement was well off its session high of 10,310.36. The tech-laden index rose 0.5% to close at 10,207.63, booking a weekly gain of 4.6%.

Top US Stocks of the Week

Shares of Coty Inc (NYSE: COTY) climbed over 13% on Monday after the company announced plans to purchase a 20% stake in Kim Kardashian West’s brand KKW for around $200 million. The company’s stock rose around 2% in the holiday shortened week.

On Tuesday, Micron Technology, Inc’s (NASDAQ: MU) shares gained about 5% following upbeat results for the third quarter and strong guidance for the current quarter. Micron’s stock posted a gain of 1.3% last week.

Shares of Xilinx, Inc. (NASDAQ: XLNX) climbed 7% on Tuesday after the firm increased its revenue outlook for the first quarter. The company added over 2% during the 4-day period.

On Wednesday, FedEx Corporation’s (NYSE: FDX) shares spiked around 12% after the delivery giant disclosed stronger-than-expected fourth-quarter results. The company’s stock gained more than 14% last week.

Shares of Steelcase Inc. (NYSE: SCS) declined by 14% on Wednesday after the company reported weaker-than-expected first-quarter results. Steelcase’s stock lost more than 10% last week.

On Thursday, Tesla Inc’s (NASDAQ: TSLA) stock climbed around 8% after the company reported deliveries of 90,650 cars in the second quarter. The electric car-maker’s shares surged to a new record, climbing more than 22% last week.

Performance of European Indices

European stocks closed lower on Friday, breaking the 4-day winning streak on the last trading day of the week, as strong economic reports were overshadowed by concerns over the continuous rise in covid-19 cases in the US.

China’s services index jumped to its highest reading in over a decade, with Caixin services PMI climbing to 58.4 in June, versus 55.0 in May. The Eurozone Market services PMI surged to 48.3 in June, versus May’s reading of 30.5, while Spain’s services PMI increased to 50.2, from the prior month’s 27.9.

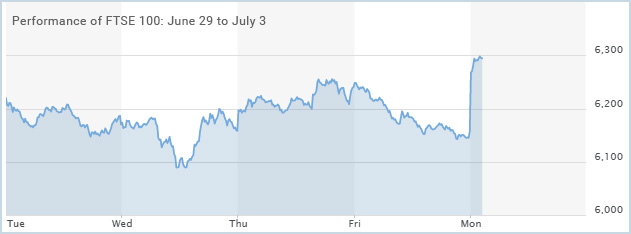

The Stoxx Europe 600 Index fell 0.8% on Friday, but posted gains of 2% for the week. London’s FTSE 100 lost 1.3% on Friday but closed flat last week. Germany’s DAX 30 and the French CAC 40 indices added 3.6% and 2%, respectively, for the week.

Top European Stocks of the Week

Shares of Energean Oil & Gas jumped more than 20% on Monday after the company cut its 2020 capital expenditure forecast.

Associated British Foods PLC’s stock rose over 4% on Thursday after the British conglomerate said it expects its Primark brand to deliver an adjusted operating profit for the full year, despite the company disclosing a 39% decline in Q3 revenues.

Shares of DS Smith fell about 7% on Thursday, despite the company recording a rise in its full-year profits. Sales to industrial customers fell during the period and management cancelled dividend payments.

The Forex Market

The British pound rallied strongly against the US dollar last week. With a bundle of economic data and Brexit-related news due for the week, markets could move in either direction in the upcoming days. The IHS Markit/CIPS UK services PMI climbed to 47.1 in June, from May’s final reading of 29.0. The GBP/JPY gained 0.1% on Friday and closed the week higher by 1.5%.

The EUR/USD pair had plunged to 1.0635 in March when global markets were crashing due to the covid-19 outbreak. The pair rebounded strongly in early June to 1.1422 and since then trading around 1.1200 for three consecutive weeks. The euro rose 0.1% on Friday, closing the week higher by 0.25% at $1.1249.

The Crypto Market

Bitcoin traded within a tight range last week, which was rough for the cryptocurrency market. Bitcoin has declined almost 1% over the past seven sessions, trading between $8,933 and $9,298.

Leave A Comment

You must be logged in to post a comment.