US stocks started the week on a positive note after China’s blue-chip stocks surged to multi-year highs. As coronavirus cases continued to rise in various states in the US and other parts of the world, tech stocks climbed, taking the Nasdaq to a new high.

The US services index also returned to expansion territory, with the ISM services PMI climbing to 57.1 points in June, which marked the biggest one-month gain in the history of the index. Gilead Sciences announced promising data of its covid-19 treatment, saying that its experimental therapy remdesivir can lower the mortality rate in coronavirus patients.

Covid-19 cases in Florida and California reached record highs during the weekend. Total cases in the country rose to a daily addition of over 60,000 last week. Various analysts warned of the resurgence of the pandemic hurting the economy and resulting in a weaker rebound in the third quarter.

Performance of US Indices

US stocks closed higher on Friday, as markets received support from optimism over a potential treatment for covid-19. However, investors digested news of a persistent rise in coronavirus cases in the country.

The Dow Jones Industrial Average climbed 1.4% to close at 26,075.30 on Friday, booking a gain of 1% for the week. The index had surged 3.3% in the previous week. After rising 1.1% on Friday, the S&P 500 index settled the week higher by 1.8%. The Nasdaq Composite Index recorded its 27th record high in 2020, closing at another all-time high of 10,617.44 on Friday. The tech-laden index gained 0.7% on Friday, booking a weekly rise of 4%.

Top US Stocks of the Week

On Monday, shares of Uber Technologies, Inc. (NYSE: UBER) gained 6% after the company announced plans to acquire Postmates in a $2.65 billion deal. Uber’s stock gained 8% last week.

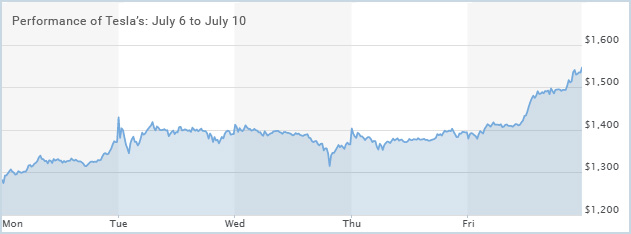

Shares of Tesla, Inc. (NASDAQ: TSLA) jumped over 13% to a new high on Monday after the company reported strong delivery figures for the second quarter. The electric-vehicle maker’s shares climbed around 28% last week.

National General Holdings Corp’s (NASDAQ: NGHC) shares climbed around 66% on Wednesday after Allstate announced plans to acquire the company for approximately $4 billion.

Bed Bath & Beyond Inc’s (NASDAQ: BBBY) stock plunged around 25% on Thursday after the company reported weaker-than-expected Q1 earnings and announced plans to shut down 200 stores. Shares of the company lost over 24% for the week.

On Thursday, Walgreens Boots Alliance, Inc’s (NASDAQ: WBA) stock slipped 8% after the company posted downbeat quarterly earnings and provided weak earnings guidance. Shares of Walgreens lost more than 4% in the week.

Performance of European Indices

European stocks surged on Friday, ending a volatile week on a higher note as concerns over the rise in coronavirus cases in the US and other parts of the world continued to worry investors.

Some economic reports were able to lift the market sentiment after Italy reported a 42.1% rise in its industrial production for May and France witnesses a strong rebound in its production. The British government announced plans to ease restrictions on gyms and swimming pools.

The Stoxx Europe 600 Index rose 0.9% on Friday and posted gains of 0.4% for the week. The German DAX 30 climbed 1.2% on Friday, closing the week higher by 0.8%. London’s FTSE 100 dropped 1%, while the French CAC 40 lost 0.7% last week.

Top European Stocks of the Week

FirstGroup’s shares nosedived 23% on Wednesday after the bus and rail-company posted a loss for the year and withdrew its guidance.

On Wednesday, Victrex’s shares plummeted around 8% after the company reported a double-digit decline in its Q3 revenue.

Shares of Airbus lost about 4% on Thursday after the company’s deliveries declined in the first half of the year. However, the aircraft maker posted a 50% rise in deliveries from May to June.

SAP’s shares rose about 5% on Thursday after the German company confirmed its earnings and revenue projections for the year.

The Forex Market

The Australian dollar tried to rally versus the greenback last week but failed to breach the 0.70 level. As widely expected, the Reserve Bank of Australia maintained its cash rate at a record low of 0.25% at its latest meeting. The Australian Performance of Services Index slipped to 31.5 in June, from 31.6 in May. The AUD/USD remained broadly flat on Friday but exited the week with a 0.1% gain.

The Japanese yen climbed to a two-week high versus the US dollar last week, with a surge in coronavirus cases in the US supporting the safe-haven yen. The Japanese yen climbed 0.55% versus the greenback during the week.

The Crypto Market

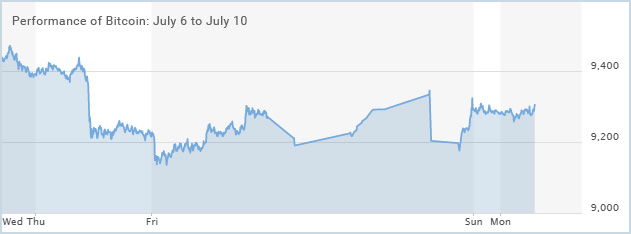

Bitcoin prices remained soft through last week, which lifted the prices of various altcoins including Tezos and Algorand, which rose sharply over the weekend. Bitcoin prices held above the $9,000 support level, trading close to $9,300 during the weekend.

Leave A Comment

You must be logged in to post a comment.