US stocks opened the week higher after closing the previous week on a negative note. as investors braced for the busiest week of earnings, while keeping an eye on discussing around the covid-19 rescue program. Positive news regarding progress on the coronavirus vaccine front also boosted market sentiment, with Moderna reporting the commencement of Phase 3 trials for its candidate.

Investors remained cautious, however, with the record rise in covid-19 daily cases and deaths during the week, especially in Texas, Florida and Arizona. The US also reported a record 32.9% contraction in its GDP for the second quarter.

Meanwhile, tech heavyweights, Apple, Amazon, Facebook and Alphabet, disclosed stronger-than-expected quarterly results. Upbeat results from the GAFA companies (Google, Apple, Facebook and Amazon) helped markets close on a stronger note on the last trading day of the week.

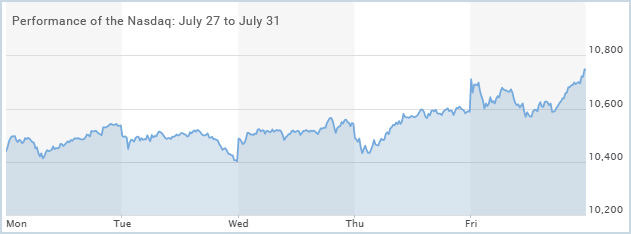

Performance of US Indices

US stocks rebounded late Friday, driven by blowout earnings from tech behemoths. Some signs of progress in talks around the new covid-19 relief bill also lifted investor sentiment.

The Dow Jones Industrial Average gained 0.5% to close at 26,428.32 on Friday, recording a 0.2% decline for the week. After gaining 0.8% on Friday, the S&P 500 index closed the week higher by 1.7%. Following the strong run in tech stocks, the Nasdaq Composite Index jumped 3.7% for the week to close at 10,745.27, following a 1.5% rise on Friday.

Top US Stocks of the Week

Shares of Moderna, Inc. (NASDAQ: MRNA) gained more than 9% on Monday after the company announced the commencement of Phase 3 trials of its covid-19 vaccine. The stock gained 1% last week.

Hasbro, Inc’s (NASDAQ: HAS) shares dropped more than 7% on Monday after the company reported weak Q2 results. The stock closed the week lower by 6%.

Shares of Tupperware Brands Corporation (NYSE: TUP) jumped around 68% on Wednesday, after the company reported stronger-than-expected Q2 results. Tupperware’s shares climbed around 70% last week.

Starbucks Corporation’s (NASDAQ: SBUX) stock gained around 4% on Wednesday after the coffee chain posted upbeat Q3 results and lifted its FY20 earnings guidance. Shares of Starbucks recorded a rise of 1% last week.

Shares of Seagate Technology (NASDAQ: STX) plummeted around 9% on Friday, after the company reported weaker-than-expected Q4 results. The stock ended the week lower by 6%.

Apple Inc’s (NASDAQ: AAPL) shares surged to a new 52-week high, climbing more than 10% on Friday, after the iPhone maker posted better-than-expected quarterly results. Apple’s stock gained around 15% for the week.

Facebook, Inc’s (NASDAQ: FB) shares jumped more than 8% on Friday, after the social media giant reported upbeat Q2 results and disclosed a 12% gain in daily and monthly active users. Facebook’s stock recorded a rise of 10% last week.

Shares of Amazon.com, Inc (NASDAQ: AMZN) climbed 4% on Friday after the company reported stronger-than-expected Q2 results and issued upbeat Q3 sales projections. Amazon’s stick gained 5% last week.

Performance of European Indices

European stocks declined on the last trading day of July, as upbeat quarterly earnings failed to overshadow economic concerns. Although China reported encouraging factory data, the US reported a massive contraction in its economy.

The French economy contracted by 13.8% in the second quarter, while Spain’s GDP declined 18.5%. The Eurozone economy shrank 12.1% during the quarter. The UK government imposed fresh lockdown measures across a swath of northern England due to fears of a second wave of the coronavirus outbreak.

The Stoxx Europe 600 Index fell 0.9% on Friday, down 3% for the week. The German DAX 30 slipped 0.5% on Friday, closing the week lower by more than 4%. After losing 1.4% on Friday, the French CAC 40 posted losses of 3.5% for the week. The FTSE 100 declined 3.7% last week.

Top European Stocks of the Week

Shares of LVMH Moet Hennessy fell 4% on Tuesday, following an 84% decline in its first-half profits.

Delivery Hero’s shares gained more than 2% on Tuesday, after the German company raised its revenue projections for the fiscal year.

Shares of Deutsche Bank AG plummeted more than 3% on Wednesday, after the bank posted a loss in the second quarter.

Banco Santander’s stock plunged 5% on Wednesday, after the bank recorded surprise losses for the latest quarter.

Shares of Barclays PLC fell more than 6% on Wednesday, after the company reported a massive decline in its pretax profits for the first half of the year.

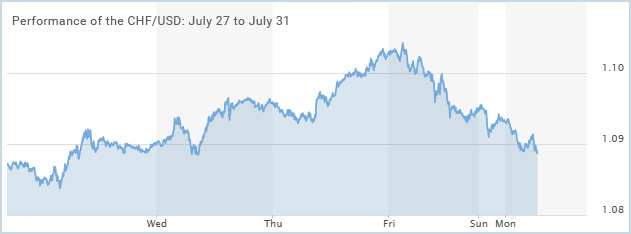

The Forex Market

The EUR/USD surged to its highest level since 2018, given Europe’s better covid-19 position than the US. While the US reported its steepest GDP contraction in history, progress on the fiscal stimulus package and higher unemployment data exerted pressure on the greenback. The EUR/USD recorded a 1.1% rise last week.

The Swiss franc climbed to its five-year high versus the US dollar last week, with the greenback’s status as a safe-haven currency remaining questionable. The Swiss franc gained 0.8% last week.

The Crypto Market

Bitcoin’s recently lost momentum now seems to be back, with the crypto major spiking more than 20% over the past ten days.

After trading sideways since early May, bitcoin returned to life last week and breached the psychological level of $10,000. The digital currency traded close to the $12,000 over the weekend.

Leave A Comment

You must be logged in to post a comment.