US markets started the week on a lower note with investors still waiting for US lawmakers to announce the new stimulus package. The week ended without any agreement reached around the covid-19 relief package, while the government is eager to pass a bill before yearend.

Meanwhile, Britain began its covid-19 mass vaccination program last week, with 90-year-old Margaret Keenan receiving the first dose of the vaccine developed by Pfizer and BioNTech. Market sentiment was kept in check by some reports of allergic reactions, which led to UK regulators advising people with a history of allergies to avoid taking the vaccine shot.

The US FDA finally gave a nod to Pfizer’s covid-19 vaccine late Friday.

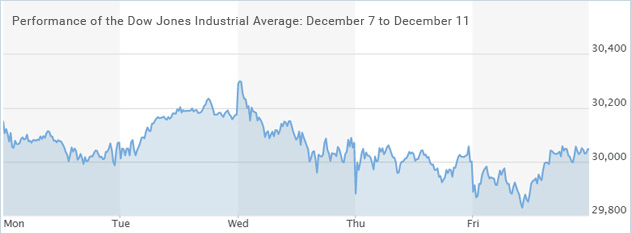

Performance of US Indices

Wall Street closed lower last week amid uncertainty around the coronavirus relief bill. Markets feared that millions of people might lose jobless benefits in the absence of fresh stimulus. Weekly jobless claims continued to rise, reaching 853,000 last week, representing the highest reading since September 19, due to the reimposition of restrictions on businesses.

The Dow Jones Industrial Average gained 47.11 points to close at 30,046.37 on Friday, but still recorded a weekly decline of 0.6%. The S&P 500 fell 0.13% to end the session at 3,663.46, taking the weekly loss to around 1%. Both the Dow and S&P 500 recorded their first weekly declines in the last three weeks. The tech-laden Nasdaq Composite moved lower by 0.23% to close at 12,377.87 on Friday, falling 0.7% for the week.

Top US Stocks of the Week

Conn’s Inc (NASDAQ: CONN) shares plumbed more than 17% on Tuesday after the company posted weak sales for the third quarter. The stock lost over 20% last week.

Shares of Toll Brothers Inc (NYSE: TOL) fell around 8% on Tuesday despite the company reporting better-than-expected results for its fourth quarter.

MTS Systems Corporation’s (NASDAQ: MTSC) stock jumped around 52% on Wednesday after Amphenol announced plans to acquire the company for $58.50 per share.

Shares of GameStop Corp. (NYSE: GME) plummeted around 20% on Wednesday after the company reported downbeat quarterly sales and announced a common stock offering.

United Natural Foods, Inc’s (NYSE: UNFI) shares slipped more than 14% on Wednesday after the company reported downbeat quarterly results.

Shares of Airbnb, Inc. (NASDAQ: ABNB) jumped around 113% on Thursday after making its public debut that morning.

Shares of Starbucks Corporation (NASDAQ: SBUX) gained 5% on Thursday after the company reaffirmed its FY21 guidance.

Walt Disney Company’s (NYSE: DIS) stock jumped around 14% on Friday after the company said that its Disney+ service had reached 86.8 million subscribers.

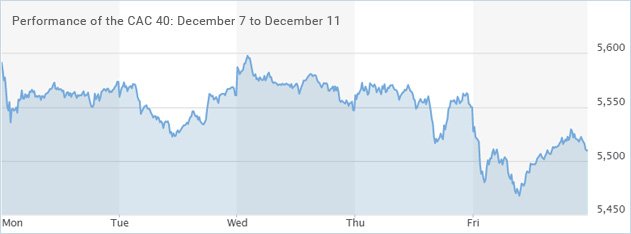

Performance of European Indices

European markets closed lower on Friday with investors monitoring Brexit talks and developments around the US stimulus. Sunday was the deadline to reach a Brexit trade deal and the disagreement over some key issues could not be resolved. Meanwhile, the European Central Bank kept its interest rates unchanged at record lows last week, while expanding its monetary stimulus program by €500 billion.

After losing 0.8% on Friday, the Stoxx Europe 600 closed the week lower by 1%. The FTSE 100 fell 0.8% on Friday, closing the week down by 0.1%. The German DAX 30 closed the week lower by around 1.4%, while the French CAC 40 dipped 1.8% last week.

Top European Stocks of the Week

Shares of Howden Joinery gained around 5% on Wednesday after the British company issued upbeat pre-tax profit projections for the full year.

Shares of Hellofresh gained around 15% on Thursday after the German company raised its guidance for the full year.

Ocado’s shares slipped around 7% on Thursday after the company reported a slowdown in revenue growth at its new joint retail venture.

Shares of Rolls-Royce shares dipped around 8% on Friday after the company lowered its cash outflow outlook.

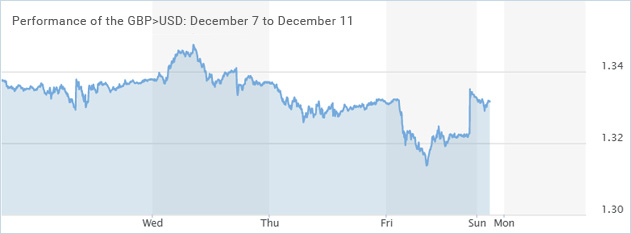

The Forex Market

The British pound was hit by the lack of agreement between EU and UK leaders. Traders were also disappointed with British Prime Minister Boris Johnson suggesting a no-deal Brexit. The GBP/USD pair shed 1.6% last week.

The US dollar initially tried to move higher versus the Japanese yen earlier but gave back gains quickly and declined towards the ¥104 level. The Bank of Japan is scheduled to announce its policy decision this week, which is likely to affect the currency pair. The USD/JPY declined around 0.2% last week.

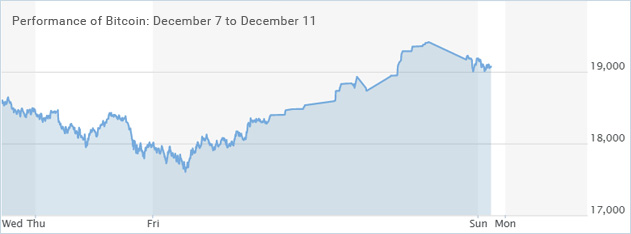

The Crypto Market

Bitcoin fell below the $18,000 level last week, declining as low as $17,904. However, the price was able to bounce back later during the week. Bitcoin traded close to $19,370 during the weekend.

Leave A Comment

You must be logged in to post a comment.