Wall Street climbed to record highs last week despite starting the week on a negative note. Hopes of US lawmakers passing the covid-19 relief bill and another pharma giant receiving FDA clearance for its vaccine candidate spurred optimism among investors.

Capitol Hill leaders said they were close to reaching a deal to provide an additional $900 billion in aid to help revive the US economy. Investors were expecting the negotiations, which have been ongoing for months, to end soon.

Meanwhile, the FDA issued an EUA (emergency use authorization) for Moderna’s coronavirus vaccine on Friday. This is the second vaccine to be approved by the US, after the one developed jointly by Pfizer and BioNTech.

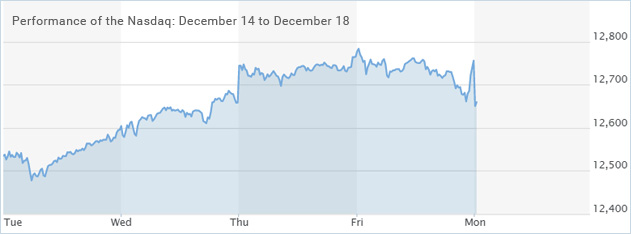

Performance of US Indices

Wall Street closed lower on Friday, even as trading volumes rose significantly with Tesla gearing up for an entry into the S&P 500. Apart from the stalled talks around the covid-19 relief package, investor sentiment was also dampened by a widening of the current account gap by 10.6% to $178.5 billion in the third quarter, while initial jobless claims rose yet again, reaching 885,000 in the week ended December 12.

The Dow Jones Industrial Average declined 0.41% to close at 30,179.05 on Friday, but still recorded a weekly gain of 0.4%. Despite declining by 0.35% on Friday, the S&P 500 added 1.3% last week, notching gains for the fourth time in the last five weeks. The tech-laden Nasdaq index outperformed the market, adding 3.1% during the week.

Top US Stocks of the Week

Shares of Alexion Pharmaceuticals, Inc. (NASDAQ: ALXN) climbed more than 29% on Monday, after AstraZeneca announced plans to acquire the firm for $39 billion. Alexion Pharma’s stock jumped 30% last week.

Pluralsight, Inc’s (NASDAQ: PS) shares added more than 6% on Monday after the company agreed to be bought by Vista Equity Partners. The company’s stock rose over 8% during the week.

Tilray, Inc’s (NASDAQ: TLRY) shares jumped around 19% on Wednesday after Aphria and Tilray announced a merger deal.

Shares of Scopus BioPharma Inc. (NASDAQ: SCPS) surged more than 473% on Thursday, as the company announced the closing of its initial public offer. Scopus BioPharma had priced its IPO at $5.5 per share.

Shares of Rite Aid Corporation (NYSE: RAD) climbed over 17% on Thursday after the company reported better-than-expected third-quarter results. Rite Aid’s stock ended the week merely 1% higher for the week.

Lennar Corporation’s (NYSE: LEN) shares climbed around 8% on Thursday after the company posted upbeat quarterly earnings. The stock gained 11% in the week.

Shares of Jabil Inc (NYSE: JBL) surged over 7% on Thursday after the company reported stronger-than-projected quarterly results.

Accenture plc’s (NYSE: ACN) stock climbed around 7% on Thursday after the company reported upbeat first-quarter results.

Performance of European Indices

European shares moved lower on Friday as investors remained worried about the outcome of the Brexit trade deal. The pan-European STOXX 600 index ended its four-session rally on the last trading day of the week despite an unexpected improvement in Germany’s business morale for December.

The STOXX 600 fell 0.4% on Friday, but still ended the week 1.5% higher, notching gains for the sixth time in the last seven weeks. Market sentiment was supported by the rollout of Pfizer’s vaccine in the UK, with Europe also expected to receive its first dose by the end of the year. The German DAX 30 index and French CAC 40 gained around 3.9% and 0.4% respectively, while London’s FTSE 100 declined 0.3% during the week.

Top European Stocks of the Week

AstraZeneca’s shares slipped around 6% on Monday after the company announced plans to buy Alexion Pharmaceuticals for $39 billion.

Umicore’s shares gained around 7% on Tuesday after the Belgian firm upgraded its outlook.

Shares of SoftwareONE surged about 7% on Tuesday after the Switzerland company expanded its leadership team.

Signature Aviation’s stock spiked around 40% on Thursday after the aviation firm confirmed being in talks with Blackstone for a possible takeover.

The Forex Market

The euro surged sharply versus the US dollar during the week with the greenback remaining under pressure due to ongoing talks over a fresh stimulus package. Demand for the European shared currency was also supported by hopes of a post-Brexit trade agreement. The EUR/USD climbed more than 1.2% last week.

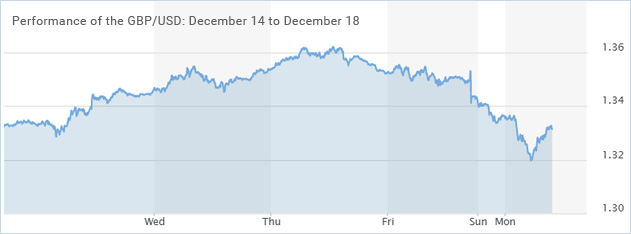

The British pound rallied above the 1.35 level versus the US dollar on Brexit deal optimism. The sterling is expected to remain highly volatile in the upcoming sessions with no resolution to the Brexit situation seeming possible. The GBP/USD surged 2.3% during the week.

The Crypto Market

Bitcoin surged past the $23,000 mark for the first time ever last week, resulted in more than 200% gains for the crypto king year to date. The cryptocurrency is also on track to recording its strongest week since May 2019. Bitcoin hovered around the $22,800 level over the weekend.

Leave A Comment

You must be logged in to post a comment.