Wall Street closed higher last week, as Joe Biden was sworn in as the 46th President of the United States. Markets recorded sharp gains on the inauguration day of the new President but soon lost some steam, as investors assessed Biden’s proposed $1.9 trillion pandemic relief package, which includes direct payments of $1,400 for Americans.

During his speech, Biden stressed on the importance of controlling the pandemic, which raised hopes of a faster rollout of vaccines.

The Labor Department also reported better-than-expected data on initial jobless claims, which declined to 900,000 last week, versus the consensus estimates of 910,000.

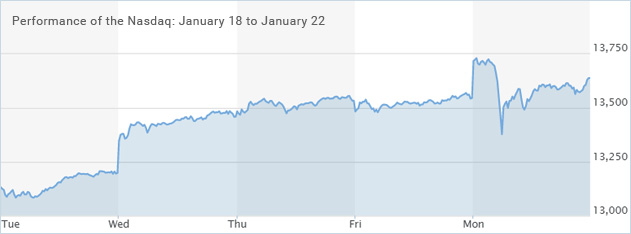

Performance of US Indices

Wall Street closed mostly lower on the last trading day of the holiday-shortened week. However, the Nasdaq climbed to another record high, as investors looked forward to a strong earnings season from tech companies next week.

Although the Dow Jones Industrial Average fell 179 points to close at 30,996.98 on Friday, the 30-stock index added 0.6% last week. The S&P 500 fell 0.3% to 3,841.47, recording a gain of 1.9% for the week. The tech-laden Nasdaq index gained 0.09% on the last trading day of the week to close at another all-time high of 13,543.06. The index surged sharply by 4.2% last week.

Top US Stocks of the Week

Shares of Coherent, Inc. (NASDAQ: COHR) climbed around 30% on Tuesday, after Lumentum announced plans to buy the company in a $5.7 billion deal. The stock jumped around 32% for the week.

Netflix, Inc’s (NASDAQ: NFLX) shares surged around 17% on Wednesday after the company posted upbeat Q4 sales and issued strong Q1 guidance.

Shares of Alcoa Corporation (NYSE: AA) fell over 12% on Thursday despite the company reporting upbeat results for its fourth quarter. The stock ended the week around 22% lower.

Broadwind, Inc’s (NASDAQ: BWEN) shares slipped 14% on Friday, after the company announced weak Q4 sales guidance. Despite the downturn, the stock added around 11% during the week.

Shares of IBM (NYSE: IBM) plummeted around 10% on Friday after the company posted downbeat quarterly sales.

Seagate Technology’s (NASDAQ: STX) shares fell around 5% on Friday, despite the company reporting strong Q4 results. Despite Friday’s dip, the stock closed last week mostly flat.

Performance of European Indices

European markets traded lower on Friday as investors assessed covid-19 restrictions and fresh economic reports from the eurozone. Business activity in the eurozone contracted to a two-month low in January due to stricter lockdowns across the region. The Markit’s flash composite PMI declined to 47.5 in January, from 49.1 in December.

The pan-European Stoxx 600 index fell 0.6% on Friday, with travel and leisure being among the worst performing sectors. The European index still added 0.2% last week. The German DAX 30 added 0.6%, while the French CAC 40 lost 0.9% last week.

London’s FTSE 100 index closed lower by 0.3% on Friday, recording a decline of 0.6% for the week.

Top European Stocks of the Week

Shares of Diploma climbed over 6% on Wednesday after the company reported revenue growth.

IG Group’s shares lost more than 8% on Thursday after the firm announced plans to buy Tastytrade in a $1 billion deal.

Zur Rose Group’s shares climbed around 9% on Thursday following robust results for the full year.

Shares of Siemens gained more than 7% on Friday, after the engineering group reported better-than-expected profits.

Volkswagen’s shares added around 2% on Friday, after the company posted upbeat profit.

The Forex Market

The British pound recorded gains versus the US dollar last week amid significant volatility. Britain recorded a sharp decline in business activity in January, with the IHS Markit/CIPS UK composite PMI falling to 40.6, from 50.4 in the prior month. However, UK retail sales grew 0.3% in December, versus a revised 4.1% decline in November. The GBP/USD forex pair added 0.7% last week.

The euro rallied sharply versus the US dollar, climbing above the 1.21 mark last week. Traders brushed off weak economic data from the eurozone, with both manufacturing and services PMIs recording declines in January. The EUR/USD pair gained 0.8% during the week.

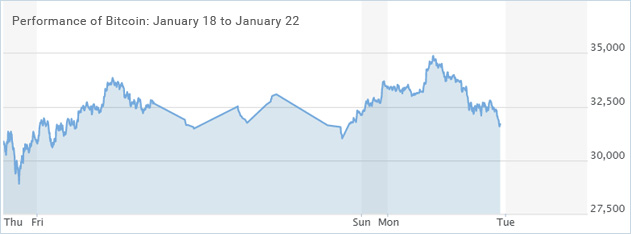

The Crypto Market

Bitcoin plummeted last week and was on track to record its sharpest weekly decline since September, following concerns over its regulation and profit-taking by investors. Bitcoin prices traded close to $32,640 over the weekend, after hitting as low as $28,800 on Friday.

Leave A Comment

You must be logged in to post a comment.