US stocks started last week on a strong note, driven by hopes of additional stimulus from the Biden administration. Wall Street wrapped up a solid week, with the S&P 500 and Nasdaq closing at fresh highs on Friday, despite a mixed non-farm payrolls (NFP) report for January.

The US Labor Department reported an addition of merely 49,000 jobs during January, versus 50,000 additions projected by experts. The unemployment rate came in 6.3%, better than the market expectations of 6.7%.

Meanwhile, Johnson & Johnson announced plans to seek emergency approval from the FDA for its single-dose covid-19 vaccine candidate.

Performance of US Indices

US stocks recorded gains on Friday, with the three major indices notching their strongest week since November. The blue-chip Dow Jones index climbed 3.9% during the week, while the S&P 500 and Nasdaq added 4.7% and 6%, respectively.

The 30-stock Dow rose 92.38 points, or 0.3%, to close at 31,148.24 on Friday, helped by gains in the shares of Nike and Cisco. The S&P 500 added 0.4% to reach a record closing of 3,886.83, while the Nasdaq Composite rose 0.6% to 13,856.30, also a new high.

Top US Stocks of the Week

GameStop Corp’s (NYSE: GME) shares remained highly volatile through the week, following a 400% surge in the previous week, driven by high retail trader interest triggered by Reddit chats. The meme stock dropped more than 80% during the week.

Shares of Express, Inc. (NYSE: EXPR) tumbled last week, following a surge in the prior week. The stock closed around 48% lower.

Shares of Koss Corporation (NASDAQ: KOSS) fell sharply after recording strong gains in the previous week, amid speculative trading. The stock lost around 69% during the week.

Sony Corporation’s (NYSE: SNE) shares climbed more 12% on Wednesday, following upbeat Q3 sales. The stock jumped around 22% last week.

Shares of Alphabet Inc. (NASDAQ: GOOGL) gained more than 7% on Wednesday, after the company reported stronger-than-expected Q4 results. The stock gained over 14% last week.

eBay Inc’s (NASDAQ: EBAY) shares climbed over 5% on Thursday, after the company reported upbeat Q4 results and issued a strong guidance for Q1. The stock added 10% during the week.

Shares of Qualcomm Inc (NASDAQ: QCOM) fell around 9% on Thursday, the company missed sales expectations.

Performance of European Indices

European stocks settled mixed on Friday with investors monitoring covid-19 vaccine rollouts for a quicker rebound in the economy. Corporate earnings continued to cause massive share price movements.

The pan-European Stoxx 600 index closed flat on Friday, with banking stocks among the top performers. The European index gained 3.5% last week. London’s FTSE 100 index closed lower by 0.2% on Friday but recorded a weekly gain of 1.3%. Italy’s FTSE MIB index recorded the strongest gains, up 7% for the week. The German DAX 30 and French CAC 40 added 4.6% and 4.8%, respectively.

Top European Stocks of the Week

Shares of BP fell around 5% on Tuesday, after the company reported a net loss for the year.

Vodafone’s shares gained around 6% on Wednesday, after the company’s organic service revenue excceded analyst expectations.

Shares of Siemens rose 2% on Wednesday, after the German company raised its full-year forecast following strong fiscal Q1 results.

Shares of BNP Paribas gained around 3% on Friday, after reporting an upbeat net income for the fourth quarter.

Neste’s shares fell 6% on Friday, after the Finnish engineering company released its fourth-quarter earnings.

The Forex Market

The British pound recorded losses during the initial part of the week but rebounded following the Bank of England’s meeting, at which the central bank held interest rates and stimulus unchanged but lowered its growth outlook for 2021. The GBP/USD forex pair added 0.2% last week.

The Canadian dollar traded higher last week, despite the country shedding higher-than-expected jobs during January. The Canadian economy lost 213,000 jobs last month, well above the consensus estimate of a 47,500 decline. The country’s unemployment rate rose 0.6 percentage points to 9.4% in January. The CAD/USD pair added 0.2% last week.

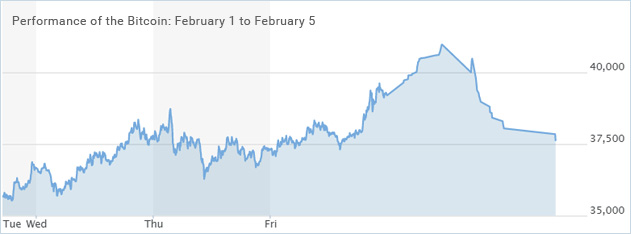

The Crypto Market

Bitcoin made a strong comeback from the past week. The digital currency continued to record gains during the weekend, surging past the $39,900 level.

Leave A Comment

You must be logged in to post a comment.