US stocks ended the holiday-shortened week on a cautious note, amid a rise in Treasury bond interest rates. US Secretary of the Treasury Janet Yellen told reporters that further fiscal stimulus is needed to help the country get back to full employment, despite some economic reports pointing towards a recovery.

Meanwhile, the Labor Department reported an increase in jobless claims for the latest week. The number of Americans applying for unemployment benefits rose to 861,000 in the week, from the prior reading of 793,000.

Markets breathed a sigh of relief as the US recorded a decline in daily covid-19 cases, with the seven-day average falling 69% from the peak level reached on January 11.

Performance of US Indices

US stocks came under pressure late Friday after recording gains earlier during the session. Big tech stocks traded lower on Friday, while cyclical shares outperformed the market.

The Dow Jones ended the session up less than 1 point at 31,494.32 on Friday, after surging over 150 points previously in the session. The S&P 500 slipped 0.19% to 3,906.71, while the Nasdaq Composite added less than 0.1% to close at 13,874.46. The 30-stock Dow index rose 0.11%, while the S&P 500 and the tech-laden Nasdaq lost 0.71% and 1.57%, respectively.

Top US Stocks of the Week

Aegion Corporation’s (NASDAQ: AEGN) shares climbed around 24% on Tuesday, after the company agreed to be acquired by affiliates of New Mountain Capital.

Shares of Wingstop Inc. (NASDAQ: WING) fell more than 13% on Wednesday, after the company reported downbeat Q4 results. The stock lost 18% in the week.

KAR Auction Services Inc’s (NYSE: KAR) shares plummeted about 14% on Wednesday, following weak Q4 results. The stock was down 23% for the week.

Walmart Inc’s (NYSE: WMT) shares declined around 7% on Thursday, following downbeat quarterly earnings.

Shares of Twilio Inc. (NYSE: TWLO) gained around 8% on Thursday, after the company reported upbeat Q4 results and issued a strong Q1 sales forecast. However, the stock still ended the week around 2% lower.

Performance of European Indices

European markets settled higher on Friday, with the release of earnings results from a number of companies and a bunch of economic reports. The eurozone flash composite PMI rose to 48.1 in February, from January’s reading of 47.8.

The pan-European Stoxx 600 rose 0.5% on Friday, with shares of basic resources leading the advance. The European index gained 0.2% last week. London’s FTSE 100 index closed higher by 0.1% on Friday, recording a weekly gain of 0.5%. The German DAX 30 lost 0.4%, while the French CAC 40 added 1.2% last week.

Top European Stocks of the Week

Shares of Barclays fell more than 4% on Thursday, after the British lender reported a 38% decline in its full-year profits.

Credit Suisse’s stock lost more than 3% on Thursday, after the lender posted a net loss of CHF353 million for the fourth quarter.

Moncler’s shares gained over 5% on Friday, after the Italian luxury fashion brand released its full-year earnings results.

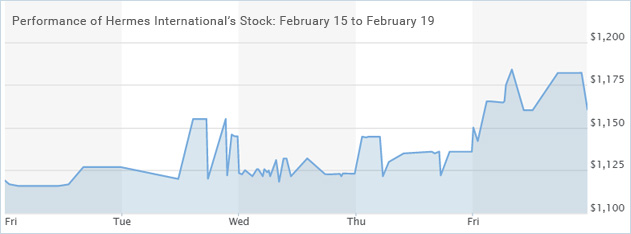

Shares of Hermes International rose more than 3% on Friday, after the bagmaker exceeded expectations for the fourth quarter.

Renault’s shares fell more than 4% on Friday, after the carmaker posted an annual loss of €8 billion for 2020.

The Forex Market

The British pound hit the 1.40 mark versus the US dollar for the first time since April 2018 last week, as the greenback remained under pressure following the weak US jobless claims report released Thursday. The sterling, on the other hand, reacted positively to Britain’s quick rollout of covid-19 vaccines. The GBP/USD forex pair added over 1.1% last week.

The euro began the week by losing ground versus the US dollar but later swung to gains. the EUR/USD closed the week almost flat.

The Crypto Market

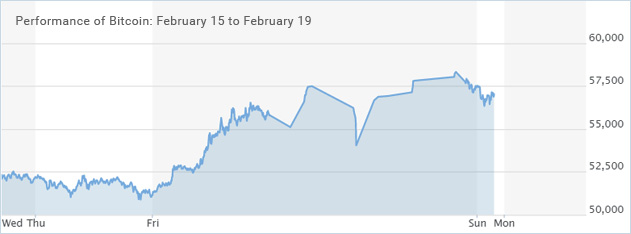

Bitcoin prices recorded sharp gains last week, with the digital-currency’s market capitalization reaching $1 trillion on Friday. The world’s most popular cryptocurrency jumped to a fresh record of over $57,400 during the weekend, taking its weekly surge close to 20%.

Leave A Comment

You must be logged in to post a comment.