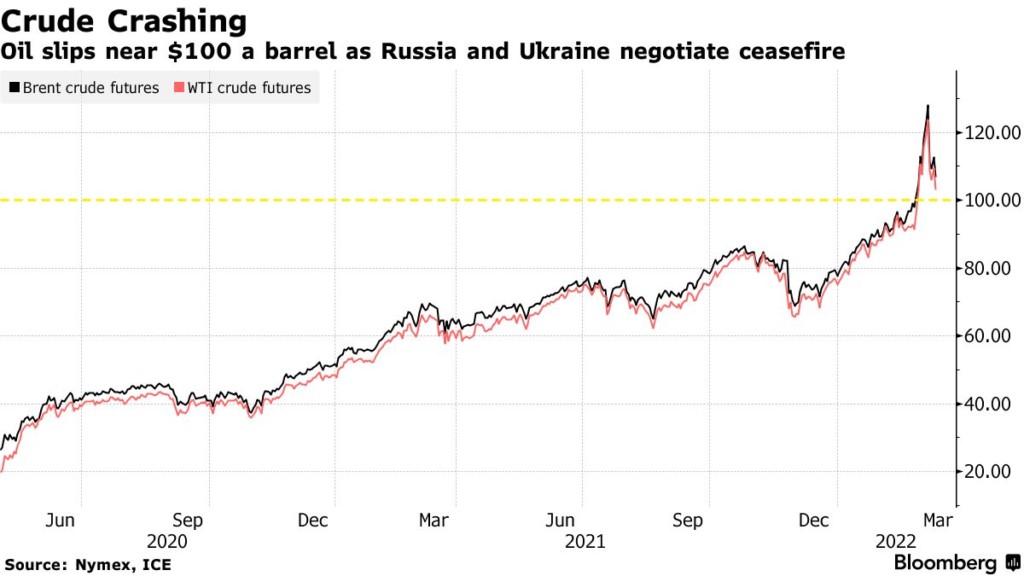

Russia’s invasion of Ukraine has rattled the global oil market. The conflict sent already inflated oil prices in the post-pandemic world to a 14-year high. On March 08, 2022, WTI crude oil soared to $123.7/bbl, while Brent crude reached a price of $128/bbl. Gold prices also surged within hours of the invasion with investors’ flight to safe-haven assets. Benchmark New York gold futures traded at $1,977/oz. on February 24, 2022.

While oil prices are always sensitive to geopolitical risks, the Russia-Ukraine war holds special significance for the market. Russia is the third-largest oil producer in the world, behind the United States and Saudi Arabia. It is also the second-largest crude oil exporter after Saudi Arabia.

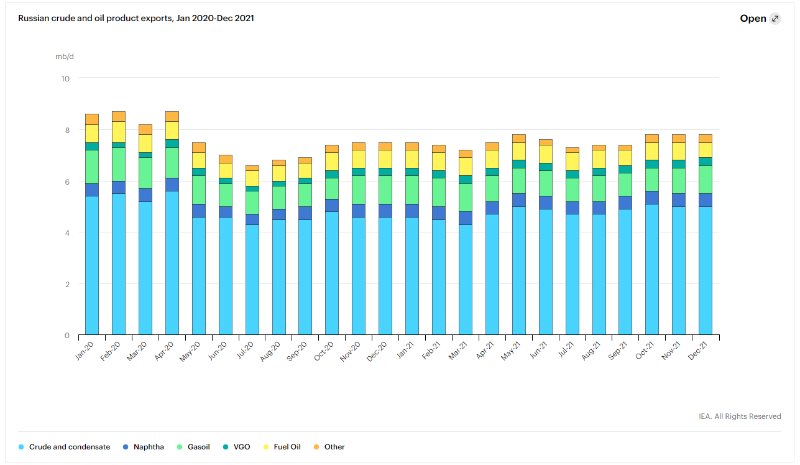

In December 2021, Russia exported 7.8 million mb/d, with 64% constituted by crude oil and condensate. Moreover, 60% of the country’s oil exports go to OECD Europe. As per the OECD, the disruptions to the flow of commodities due to the Russia Ukraine conflict will severely impact the Eurozone economy, and take off 1 percentage point from global growth in 2022.

The sanctions against Russia could further cripple energy exports worldwide. Oil prices surged 4% higher on March 09, 2022, as the US banned energy imports from Russia. Prices soared again on March 21, as the EU considers an import ban as well. The world could be experiencing one of the largest energy supply shocks, as per Goldman Sachs which has raised its 2022 Brent oil price forecast to $135/bbl from $98.

Ceasefire and Other Factors That Could Bring Down Price

So far high-level talks between Ukraine and Russia have failed to provide any results. But, should such talks lead to positive outcomes oil prices might come down in the near term. On March 14, 2022, global oil prices came down below $100/bbl, as negotiations between Russia and Ukraine started.

The prospect of a diplomatic solution could indeed ease the supply shock globally, which has sent commodities prices to extreme highs. However, there are also other forces at play that could hurt oil demand. China and the EU are currently experiencing a surge in Covid-19 infections. China has imposed tough lockdown measures for the first time since April 2020. Around 17.5 million people in Shenzhen are living under a lockdown, and travel restrictions have been imposed in the Jilin province. China is one of the biggest importers of crude oil.

Further, surging fuel costs have added to inflationary trends globally. Many central banks, including the US Fed, will likely increase interest rates for the first time since 2018. The strengthening of the US dollar could put downward pressure on oil prices.

Trading Oil Volatility the Right Way

It is hard to predict the outcome of the Russia-Ukraine war. What is clear is that traders need to brace for a period of high oil price volatility, driven by war and tight market fundamentals. The prospect of Iranian oil flooding the markets have been dashed with Moscow demanding separate terms, throwing the talks into disarray.

Trading With Derivatives

Traders can use derivatives like contracts for differences (CFDs) to leverage the opportunities from volatile oil prices. They can trade on the price movements of the underlying asset (Brent Crude or WTI Crude benchmark) without buying oil at the spot price. If the price is expected to rise, they can go long, or go short otherwise. Leverage can offer better exposure to the market, but it can also magnify losses. This is why traders need to exercise a proper trading strategy, including risk management plans.

Understanding Factors That Drive Prices

The supply and demand of oil are 2 major aspects that determine oil prices. The supply part includes:

- OPEC (Organization of the Petroleum Exporting Countries): The cartel’s production cuts and extensions can impact oil prices. It’s important to track the news about their meetings and resulting policies.

- Outages and Attacks: Any news about maintenance of key refineries worldwide or an attack on a production facility can cause prices to soar.

The demand side includes factors like:

- Consumer Countries Outlook: Oil consumption has increased in countries like China, India, Japan, and other nations in the EMEA. Their economic performance as well as news of new virus outbreaks must be tracked. A slowdown could hamper demand and prices may fall.

- Seasonal Variations: Cold winters mean European nations increase consumption of heating oil. In the summers, transport fuel is in demand in countries like the US.

- Global Growth: Global economic growth has a positive correlation with oil prices.

- Alternative Energy: Countries like Europe are rethinking their reliance on fossil fuels. Businesses are being pushed to transition towards a sustainable future, this can impact oil prices.

On a robust trading platform, technical and fundamental analysis becomes easier. With a 1:2 risk-reward ratio, traders can ensure optimum risk management. This is critical to navigate this uncertain landscape of war.

Leave A Comment

You must be logged in to post a comment.