Are you still targeting search engine rankings and blasting prospects with generic emails? That might not be enough to entice customers in the overwhelmingly crowded financial services space. Smart marketers are adopting intent-based marketing strategies to attract, engage, convert, and retain clients. Targeting intent helps you cut through the noise and connect with your audience meaningfully. Over 68% of marketers using intent data report improved lead quality. Intent data enhances personalisation, which sharpens targeting. In fact, research shows that considering user intent can increase the conversion rate by 18% in the B2B space.

Intent-Based Marketing: Sales Pitch that Mirrors Intent

Leveraging intent data eliminates the guesswork from marketing and helps brands target with precision. For example, Singapore-based DBS Bank DBS Bank uses intent data to create personalised experiences and drive marketing. Its DBS Marketplace allows customers to search for homes, cars and loans. By analysing data, DBS can tailor offers and content to specific customer needs, turning its digital platform into a hub for related financial and lifestyle services based on user behaviour and intent.

Intent data enables you to target leads with high conversion potential while drawing in more prospective clients. Intent-based marketing works across the sales funnel stages, shortening sales cycles and increased sales productivity. Marketers who reap the most benefit from it employ intent-centric techniques throughout the sales funnel.

Hyper-Personalisation: The ‘Soul’ Purpose Intent Data

The key is to personalise, not just based on where a user started, but where they have reached. Intent signals shift throughout the user’s journey, and so should your fintech’s messaging.

For instance, during discovery, education is important. A credit card buyer is likely to look for blogs and industry articles that talk about features and perks to look for. Their clicks on your content matter at this stage.

By the time they reach mid-funnel, the time spent on case studies, webinars registered for, products viewed, and additions to cart, etc., is more valuable.

During late-stage evaluation, competitor interactions, comparisons, etc., offer insights. At this time, highlighting your USPs could be a game-changer.

Notably, while fintech push notifications have a click-through rate (CTR) of 2.25%, personalising those communications can raise the CTR to 5%. Niyo, an early-stage fintech, used personalised targeting, which improved the brand’s conversion rate by 40%.

A credit-card buyer could be comparing air miles or movie tickets, whatever interests them. Intent-based marketing helps you make the buyer feel understood and not sold to. Payment processor, Stripe, for instance, targets customers by answering high-intent questions. The brand combines AI-powered analytics and machine learning-based SEO to identify long-tail keywords and niche-specific terms. This has helped the company stand out from the competition. In September 2025, the brand’s website received 147.7 million visits with an average session lasting for 8:14 minutes.

Fluid Customer Profiles: Evolve Signals with Intent

As the customer progresses through the sales funnel, your data requirements shift from first-party to third-party. For instance, in the initial stages, all you need is the number of times a potential customer viewed your website or clicked on your advertisements. You can get this information from Google Analytics or your CRM. At later stages, you need broader data. This includes insights into competitor interactions. These can help you adequately position your brand and determine the likelihood of the customer staying with your brand or drifting away. This is where you need support from third-party data providers.

Tools to Power Intent-Based Targeting

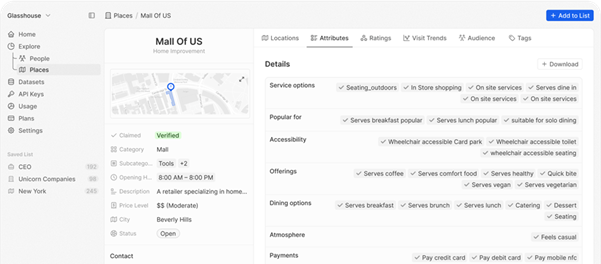

Intent data tools analyse massive customer datasets to report what your potential buyers are looking for. Choosing one that offers accurate insights, AI-powered predictive analytics, and integrates with your marketing tool-kit is important. Plus, as a fintech, ensuing that your chosen data intent platform is compliant with the regulations of the region you operate in is non-negotiable. Here are a few tools you can choose from:

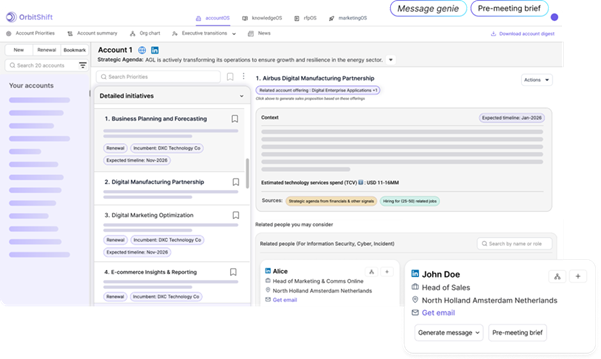

OrbitShift

Although the platform’s Message genie suggests targeted communications, human supervision is necessary to ensure you remain compliant.

Data Coverage: Industry-wise identity graph with AI-powered, solution-level intent. Provides account, buying group, and persona intelligence from diverse data sources.

Personalisation Capabilities: Enables targeting of high-intent buyers (accounts and individuals) with hyper-personalised message and content-style suggestions. Also offers real-time contextual outreach templates.

Integration: Connects directly to existing CRM, marketing automation (MAP), and customer data platforms (CDP) via custom-built integrations.

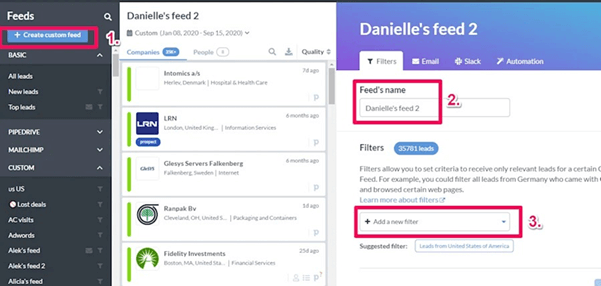

Leadfeeder

Leadfeeder’s USP is its wide range of filters that help guide marketing teams.

Data Coverage: Identifies anonymous website visitors and turns them into real company names, including remote workers. Uses a machine learning algorithm for a fresh, accurate IP-to-company database, and the data is scrubbed of bots and ISPs.

Personalisation Capabilities: Enables custom segmentation with 50+ behavioural and firmographic filters, scores visitors automatically, based on web activity, for lead qualification.

Integration: Integrates natively with all major CRMs and marketing automation tools and automatically syncs visit data.

Factori.ai

Factori.ai offers the most comprehensive user data with access to the global digital journey of regional customers.

Data Coverage: Real-time people data, global coverage, customisable solutions, and comprehensive privacy compliance.

Personalisation Capabilities: Granular customer segmentation, 360-degree customer data, facilitates power channel-based cross-channel marketing.

Integration: Library of pre-built connectors, supports custom formats and delivery schedules for integration with various analytics and business intelligence (BI) systems.

Building an Intent-Based Marketing Strategy for Fintech

The first step is to define your ideal customer profile (ICP). These are customers with high conversion intent. This is where your most rigorous marketing efforts go. They could be at the later stages of the funnel.

Next, establish brand relevance. Identify what your ICP is looking for. This includes determining keywords that align with their pain points, services they are looking for, etc. Their online search could be related to these issues when they first discovered your brand.

Once you know what they are looking for, employ intent-based marketing tools. Catch intent signals and deliver personalised communications. Carefully build on frequency and strategically position yourself as more desirable in the area they are targeting.

Use your ICP’s signals as guides for content creation. Craft highly targeted blog posts, whitepapers, product reviews, and case studies. This content is based directly on data-derived insights from the intent tools.

Finally, launch focused email and advertising campaigns, while prioritising AEO and personalised messaging. Intent-based targeting also enables you to deploy ads only to users who are actively searching for your offerings. This maximises ROI on your ad spend.

Continuously measure how effective your intent-powered campaigns are. Prioritise the leads showing the strongest intent signals for immediate follow-up. Use performance results to optimise your content strategy. Track performance metrics, such as intent-to-opportunity ratio, conversion rate, etc.

Aligning Your Marketing Materials with Intent

All kinds of marketing content have a targeted impact. Using each wisely differentiates winning campaigns.

1. Blog Posts: Awareness Intent

While a generic blog discusses budgeting tips, an intent-based blog addresses the specific terms your ICP is using for online search. For instance, how can I increase my savings on a tight budget? Understanding the intent means learning about a problem they want solved.

2. Whitepapers/Guides: Consideration

An intent-based guide by a broker would be beyond a generic risk management guide. It would explain which instruments are the best hedges for the asset a trader is interested in.

3. Case Studies: Decision

When presenting a case study, offer prospects a peek into what they could miss out on if they didn’t choose you. An intent-based case study is sent after the client visits your pricing page. This may offer social proof, statistical improvements, etc. For instance, a bank could highlight how its credit products benefited borrowers in the same category as the lead.

4. Emails: Reconsideration, Keeping in Touch

A generic email shares a newsletter. An intent-based email’s subject line uses a product feature that the potential customer searched for and offers a quick, personalised call to discuss.

5. Ads: Retargeting

A generic ad promotes your brand name while an intent-based ad targets an account that researched a competitor’s product. The ad creative highlights your superiority to directly influence their choice.

Word of Caution

Remember not to push sales or even gated assets too early in the funnel. These may deflect the lead. Instead, carefully pick when to pitch what. For instance, pitching a discount in the awareness stage can be overkill. The same pitch in the decision stage can instantly elicit favourable action.

Ready to Launch an Intent-ional Campaign?

Over a third of marketers find converting intent data into actionable outcomes challenging. To develop content strategies that align with every user persona at every stage, you need experts who truly understand intent-based communication. With over two decades of implementing impactful content marketing for fintechs worldwide, Veda Informatics understands exactly what makes a campaign intent-aware. Speak to the Veda experts to improve your marketing ROI with targeted messaging.

Leave A Comment

You must be logged in to post a comment.