An Initial Public Offering (IPO) is a quick way for a company to gain funding for expansion and growth. It also helps the company gain publicity and credibility while opening up the biggest source of funds for it. Also, it gives investors the opportunity to get a slice of the organisation’s growth pie. When multiple IPOs are issued, it is seen as a sign of a health economy and stock market.

Benefits of Investing in an IPO

When your financial goals align with these advantages of investing in an IPO, it could be a smart investment choice. Remember, #YMYL!

- Early entry: IPOs give you the chance to get in on the action early and capitalise on a company’s growth potential. When you invest in a promising business, it could help you create wealth over time.

- Cheap entry: For a company with good growth potential, the IPO could offer a cheap way to gain exposure. There are many instances where the share price skyrockets after the IPO.

- Transparency: The share price is clearly mentioned in the IPO brochure or document. This gives individual investors access to the same information as institutional ones.

- Achieve financial goals: The equity market is known for its high risk/high return nature. This market tends to reward long-term investors.

Fun Fact

Did you know that the Oracle of Omaha, Warren Buffet, missed the boat when Amazon held its IPO in May 1997? The stock was priced at $18 per share at that time. If Buffet had invested at that time, he would have earned a whopping 115,933% return by the time the IPO completed 25 years in May 2022!

Guide to Investing in an IPO

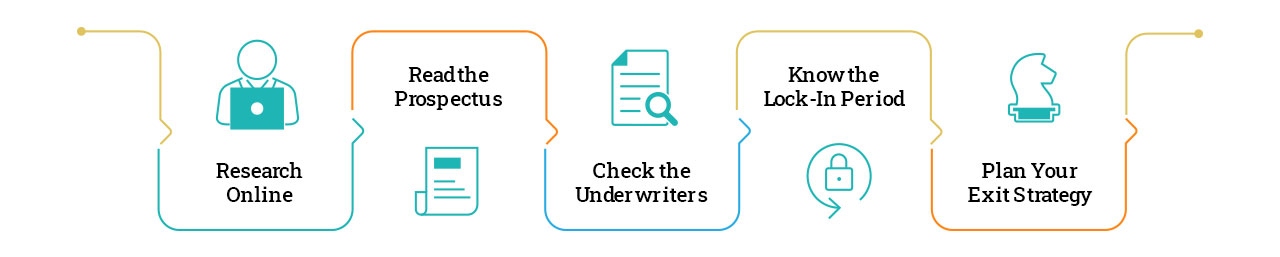

The first step to participating in an IPO in India is to open an account with a broker. Companies notify brokerages when they issue an IPO. The brokers, in turn, inform their clients. Most brokers might have eligibility criteria, such as the funds available in their brokerage account, before an investor can participate in the IPO. Once you’ve decided to invest, here are some crucial steps to make an informed investing decision.

Dig Deep and Do Your Own Research

Researching a company that is about to go public can be difficult because private firms are not bound by stringent disclosure guidelines. Even when experts give their opinions about the company, they rely on publicly available information, which is limited. The red herring prospectus, which is published prior to an IPO is created by the company. So, negative information might be glossed over.

Start with looking up information regarding the company online. Check its financials and competitors. Look for past press releases and learn about the health of the overall industry. Your research might just help you read through the lines of the prospectus and guide you to make a smart investment.

Read the Prospectus

Although you can’t make your decision based on the prospectus alone, this is one step you shouldn’t miss. The red herring prospectus can be obtained from the company’s website, the SEBI website, the website of the stock exchange, and magazines and newspapers. Going through the details will help you understand the opportunities and risks of investing in the IPO and how your invested capital will be used by the company. The prospectus will also give you insights regarding the background of the organisation, why it is going public and who its promoters are.

Fun Fact

IPOs in India recorded an all-time high in FY2022, garnering a total of ₹1,11,547 crore. Of this, ₹20,557 crore or 39% of the total was accounted for by the LIC IPO alone.

Choose a Company with Strong Underwriters

IPOs are managed by underwriters or brokers. This doesn’t mean you should only choose a company with the largest investment bank as its underwriter. But you should exercise caution when looking at smaller brokerages because they might not afford to be picky and be willing to underwrite almost any company. On the other hand, there have been times when well-established brokers have underwritten for failed IPOs. The only recourse is to do your research well.

Check the Lock-In Period

Every IPO has a lock-in period during which time company insiders and underwriters cannot sell their shares. It is useful to keep an eye on whether these investors begin selling their shares when the lock-in period is over. If they start selling at the end of the lock-in period, the share price is likely to fall. On the other hand, if they hold on to their investment, it could mean that they believe the company has a bright future.

Fun Fact

The best performing Indian IPOs of 2022 were Adani Wilmar, which gave returns of over 128% by the end of the year, Hariom Pipe Industries, with returns of 116% by the year end and Venus Pipes & Tubes, giving returns of 115% by end 2022.

Plan Your Exit Strategy in Advance

Like any other investment, make sure you have your financial goals in mind while investing in an IPO. This means you need to plan beforehand the level at which you will sell the shares to earn a profit. Short-term investors usually determine their exit levels even before buying a stock. In fact, stop loss and take profit levels are proven risk management strategies, used by traders worldwide. Even if you have a long-term focus, it is always useful to remain cautious understand the risks of investing in an IPO.

Fun Fact

The largest IPOs of all time are Saudi Aramco, which raised $25.6 billion in 2019, Alibaba, which raised $21.8 billion in 2014 and Softbank, which raised $21.3 billion in 2018.

Key Takeaways

- IPOs can be a good way to gain exposure to the stock market at a relatively cheap price.

- It is difficult to sift through the chaff when looking for an IPO to invest in, making research crucial.

- Choose an IPO after reading the red herring prospectus and checking on the underwriter.

- Wait to check whether company insiders and the underwriter sell their shares after the lock-in period is over.

- Plan your exit strategy beforehand.

Leave A Comment

You must be logged in to post a comment.