The good news for brokers is that online trading is seeing a huge rise in popularity, thanks to advances in technology. Unfortunately, this move to online trading also gives opportunities for hacktivism. Brokers collect and store sensitive personal and financial data, which makes them tempting targets for cyber criminals. A cyber-attack can lead to significant losses for brokers, not just in monetary terms but also in reputational damage and loss of trust.

Cyber Threats Brokers Should be Aware of

Financial services providers, such as brokers, not only need to protect themselves and their infrastructure, but also their clients, through a proactive approach. Some of the most common access points for cyber criminals that brokers should be aware of include:

- Trojan viruses

- Phishing attacks that target clients and try to steal their login credentials

- Intercepting money transfers

- Deleting, corrupting or modifying security records

Another area of concern is the rising use of mobile trading platforms. This has made smartphones the new target for cyber criminals. With businesses seeking to capitalise on the popularity of apps, application security spending is expected to cross $7.5 billion in 2023 from $6 billion in 2022.

Against this backdrop of diverse points of access, here’s a look at cybersecurity trends that brokers can capitalise on to protect themselves and their clients.

Top Cybersecurity Trends for Brokers

Malware and Viruses

Viruses and malware are among the most common cyber threats for brokers, which usually take the form of spyware, Trojan horses and phishing emails. If a broker’s system is compromised, the cybercriminals gain access to clients’ login credentials, trading data and other sensitive information.

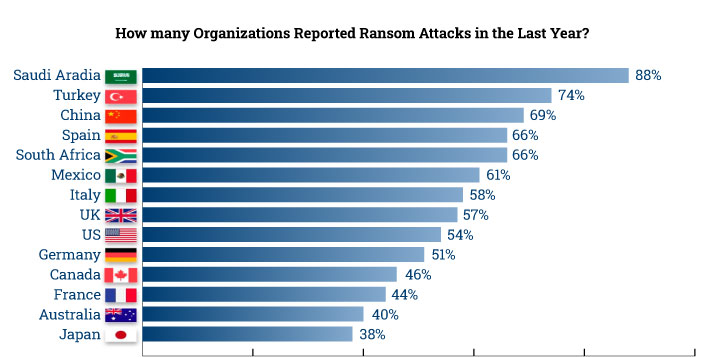

Targeted ransomware is another significant concern. The Ransomware Report 2023 by Outpost24 identified a total of 2,363 disclosed victims from 101 different countries. Of the registered victims, 42% were from the US. Given that brokers rely heavily on software solutions, they become targets for hackers seeking a ransom in exchange for not publishing client data.

Data Breaches

Any vulnerability or bug in a broker’s digital ecosystem can give hackers access to clients’ financial information. This can lead to significant monetary losses for both clients and the brokerage, along with reputational damage. In the worst-case scenario, the reputational damage could be irreparable.

This highlights the needs for brokerages to invest in powerful encryption tech and firewalls. Regular security audits and software updates can help identify and fix any vulnerable areas before hackers gain access.

Human Error

While we work on refining artificial intelligence, we still need to find a way to deal with lapses in human intelligence! Weak passwords, misplaced smartphones or laptops and failure to comply with security protocols can all open up a broker’s digital infrastructure to malicious elements. It is important to educate employees on the need to follow stringent protocols, including regular password changes.

Social Engineering Attacks

Con men (or women) can manipulate, deceive and influence victims offline and online. In the world of cybercrime, it is known as a social engineering attack. This type of cyber threat won the first position for the most common type of cyber-attack in 2022. Whether through phishing emails or other types of online scams, cyber criminals can fool clients and employees into revealing sensitive information.

Here too, educating both employees and clients is indispensable to ensuring the safety of sensitive financial data.

Regular employees and contractual workers with access to confidential, sensitive information could pose a threat. They could intentionally misuse such access for their own gain or to harm the brokerage. This highlights the need for brokers to ensure stringent background checks and the monitoring instances of access to sensitive data.

Coping with Cyber Threats

Research firm Gartner believes that these cybersecurity trends will lead to organisations modifying their security strategies to address 4 priorities:

- Building responsive ecosystems that enhance organisational readiness.

- Restructuring points of access and ensuring greater security coverage.

- Modifying security practices to focus on technology, process and people.

- Establishing balanced, sustainable cybersecurity protocols.

Veda has wide experience in developing educational materials for employees and customers in the financial sector to create awareness regarding cyber-attacks. Contact us today to discuss how we can help you with you internal content needs.

Leave A Comment

You must be logged in to post a comment.