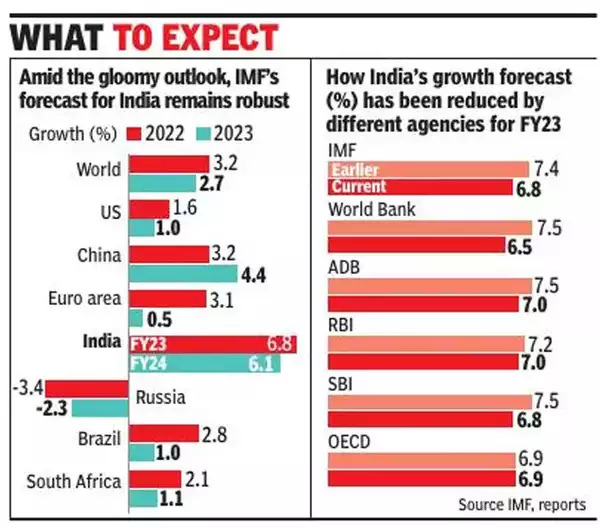

Just a couple of years back, we waited with bated breath for the pandemic to ease and for global economic growth to reaccelerate. In 2022, that became a fast fading dream. Storm clouds gathered over the global economy, as the US Fed continued its aggressive tightening spree, the EU got engulfed in an energy crisis and China battled with continued covid restrictions. In fact, a third of the global economy is expected to contract this year and the prospects for next year are not much brighter. The IMF forecasts a slowdown from 6.0% in 2021 to 3.2% in 2022 and to 2.7% in 2023.

India in the Limelight

The focus is now on India, the world’s fastest-growing economy today. Yes, inflation is high and a concern. But it’s nothing new. We’ve been dealing with high inflation for years. Although inflation has accelerated from 2017 to the current 7%, we’ve gone through worse – double-digit inflation or nearabout every year from 2008 to 2013. The country has exhibited great resilience and is likely to continue to do so even in the face of a global economic slowdown.

While most major economies gasped for breath, India recorded GDP growth of 13.5% in the April to June quarter. The Indian economy is projected to grow by 5.9% in 2023. Although this is higher than the global average, it marks a slowdown from the estimated 6.9% in 2022. This is concerning for a developing country like India.

Image Source: The Times of India

Image Source: The Times of India

The real question is: Does India really have the wherewithal to spearhead global economic growth? The answer depends on the resilience of the fintech sector.

Money Makes the World Go Round

Private enterprises are the chief agents of economic growth. Their role in creating employment, generating prosperity, and driving innovation cannot be overstated. If you’re thinking only of the Reliance and Tata group of companies, think again! Indian SMEs contribute nearly 30% of the country’s GDP and 45% of total exports, while employing around 460 million people. Most of these companies are cash strapped and need easy and speedy availability of working capital to tide through uncertain times.

Moreover, for these businesses to meet their goals, India’s consumer spending needs to remain strong. Consumer spending declined from ₹23.3 lakh crores in the first quarter of 2022 to ₹22.6 lakh crores in the second quarter, with prospects of a global recession grabbing the headlines. Consumer spending can also be supported by the easy and affordable availability of credit.

Fintech: A Friend in Need

Finance is the lifeblood of growth and it’s only fintech firms that can cater to this. Why? Legacy banks are unable to cater to the need for small-ticket loans with short timeframes, given their huge overhead costs, substantial documentation needs and complex procedures. The door was left wide open for fintech firms to step in and offer financing on the fingertips. Backed by cutting-edge technology, fintech introduced financing solutions for businesses and individuals that were so far tossed aside by traditional financial institutions.

Fintech is Forging Ahead

It didn’t take long for India to fall in love with fintech. The country’s fintech adoption rate of 87% (as of September 2022) was substantially higher than the global average of 64%. This helped the fintech industry to grow at the breakneck speed of 300% to a market size of $50 billion in 2021. The industry could reach $150-$160 billion by 2025, according to the India FinTech: A USD 100 Billion Opportunity report by the Boston Consulting Group (BCG) and Federation of Indian Chambers of Commerce and Industry (FICCI).

Several factors have aided fintech’s exponential growth in India, including high smartphone penetration, a large digital-native population and the government’s pro-business policies.

How Phenomenal is Fintech?

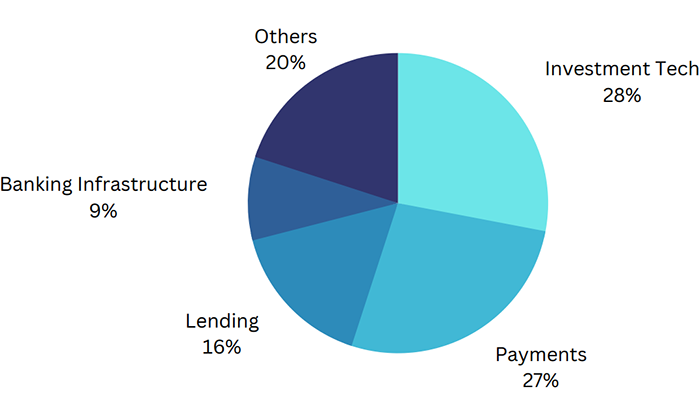

Fintech goes beyond UPI and digital wallets. It includes BNPL (buy now pay later), InsureTech and WealthTech.

Fintech by Segment

The pandemic induced a secular shift in the way India shops. Online shopping garnering momentum led to a quantum leap in BNPL (under LendingTech), which integrates instant EMI-based credit at checkout. The BNPL segment is expected to grow at a CAGR of 80% to a whopping $4,300 crores by 2025. Companies like axio have played a key role in making credit accessible and affordable. axio was able to grow its customer base from 2 lakhs to 60 lakhs in just two years by creating a seamless credit experience for customers to meet their essential and aspirational needs.

The phenomenal growth of fintech has not been easy, rather has come against a multitude of challenges, including low financial literacy and a rapidly evolving and highly competitive landscape. Despite these hurdles, the reliance on sophisticated technology has enabled fintech companies to extend the reach of their services to people and businesses that would otherwise have no access to credit.

Driven by advancements in communications and digitisation, fintech is poised to accelerate India’s economic growth and help the country become the world’s third-largest economy by the end of this decade.

Leave A Comment

You must be logged in to post a comment.