Last week started with excitement around the reopening of most economies around the world, businesses beginning to open their shutters and people getting ready to move out of their homes. But the euphoria didn’t last long. The bears began their prowl again, following downbeat remarks by the Federal Reserve Chairman Jerome Powell, pushing the markets lower for the week. The top-ranking Fed official warned of an extended recession and said he expects the country’s government to pump more money into the markets to save the economy, which is witnessing millions of job losses. Jerome Powell’s remarks came after the US reported record losses of 20.5 million jobs in April. Powell also said that the Fed was against the idea of negative interest rates.

Performance of US Indices

US stocks ended the week in positive territory on Friday, following news of US House of Representatives planning to vote on a new $3 trillion COVID-19 stimulus package. Despite this upturn, the markets were down for the week. The Dow Jones Industrial Average, which rose 61 points to 23,685.42 on Friday, posted a weekly loss of 2.7%. The S&P 500 index added 0.4% on Friday, but closed the week lower by 2.3%. The Nasdaq Composite Index once again performed much better than the other indices, losing just 1.2% for the week.

Top US Stocks of the Week

Shares of AMC Entertainment Holding skyrocketed 30% on Monday, following news of Amazon being interested in acquiring the theater group. The movie chain’s stock closed the week higher by more than 10%.

Marriott International’s shared fell around 6% on Monday, after the hotel operator posted disappointing earnings for its latest quarter. Marriott’s stock ended the week lower by 9%.

GrubHub’s stock spiked 29% on Tuesday on reports of Uber Technologies looking to acquire the food-delivery company. GrubHub’s shares climbed more than 17% during the week.

Shares of Cisco Systems rose around 5% on Thursday, after the tech giant reported stronger-than-expected earnings for the recent quarter. The San Jose, California-based company’s shares gained 3% last week.

Performance of European Indices

The European markets ended mostly higher on the last trading day of the week, but posted losses for the week as investor fears were fueled by rising US-China tensions. The pan-European STOXX 600 index gained 0.9% on Friday, but was down 3.8% for the week.

Germany reported disappointing GDP figures, with the Europe’s largest economy shrinking 2.2% in the first quarter. The German DAX 30 closed higher by 1.24% on Friday, posting a weekly loss of over 4%. The French CAC 40 rose slightly by 0.11% in the previous session, but was also down around 6% last week.

Top European Stocks of the Week

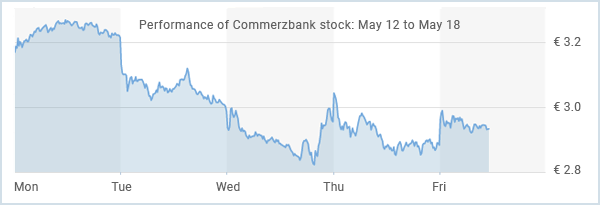

Shares of Commerzbank fell 7% on Wednesday, after the German lender posted a loss of €295 million for its latest quarter due to higher loan loss provisions. Commerzbank’s stock tumbled by 11% last week.

Vodafone’s stock gained 8% on Tuesday, after the telecom company decided to pay dividends, despite recording a massive loss of €455 million for the year.

On Tuesday, shares of Land Securities were down 12% after the British property firm reported significant losses for the year.

The Forex Market

The US dollar recorded strong gains versus the Japanese yen last week, rising past the ¥107 mark. The greenback had surged past the ¥108 level during trading, but was unable to hold the position and pulled back slightly to close above ¥107 last week. Japanese producer prices fell 2.3% year-over-year in April, while the country’s current account surplus shrank to ¥1.97 trillion for March.

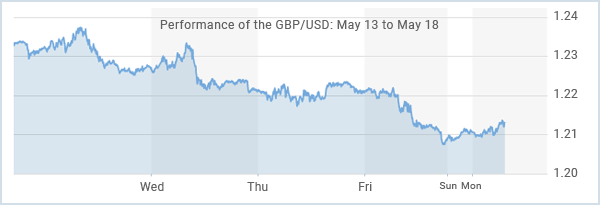

The pound dropped against the US dollar on Friday, recording its second-consecutive weekly decline. The pair declined to $1.2118 during the previous session, hitting a seven-week low. Britain surpassed Italy and Spain in term of the number of positive coronavirus cases and is now leading with the highest number of cases in Europe. Earlier this week, Britain reported that its GDP had contracted by 2% in the first quarter, recording its biggest decline since 2008.

The Crypto Market

In yet another volatile week for Bitcoin, the king of digital coins tumbling to $8,100 early in the week and then made a sharp recovery to $9,944 on Thursday. The digital currency traded within a price range of nearly $2,000 last week.

Investors believed the halving event was overhyped, creating a volatile environment for the currency ahead of the event. Analysts remain bullish about the long-term prospect for this cryptocurrency. Bitcoin was trading higher by around 4% at $9,576 in European trading today.

Leave A Comment

You must be logged in to post a comment.