US stocks started the week on a strong note on Monday last week, as investors cheered news of positive trial results for covid-19 vaccine candidates. Pfizer reported that two of its vaccine candidates had been awarded FDA’s Fast Track designation. Moderna joined in to issue some encouraging data for its covid-19 candidate, showing that the vaccine produced neutralizing antibodies in infected patients.

Investors remained cautious, however, with the US reporting a record spike in the daily numbers of coronavirus cases to over 70,000. The spike heightened fears of the recovery of the US being far slower than was earlier anticipated.

Economic reports were also mixed during the week, with jobless claims easing only slightly versus the previous week and coming in higher than expected. Major banks kickstarted the earnings season last week, with many reporting better-than-expected quarterly earnings. Markets remained concerned, however, over the higher loan-loss provisions maintained by banks.

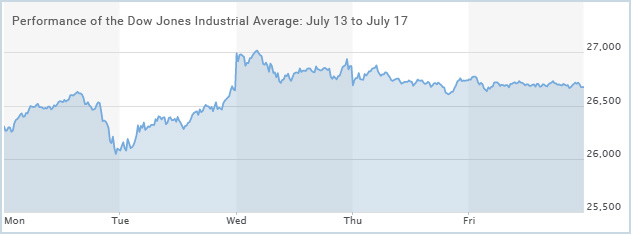

Performance of US Indices

US stocks closed mixed on Friday on disappointing consumer sentiment data, while covid-19 cases continued to surge. Investors also gauged the potential for further fiscal stimulus. Markets finished mostly higher last week, boosted by promising covid-19 vaccine data by pharma companies.

The Dow Jones Industrial Average fell 0.23% to close at 26,671.95 on Friday, booking a gain of 2.3% for the week. After rising 0.28% on Friday, the S&P 500 index closed the week higher by 1.3%. The Nasdaq Composite Index bucked the trend and settled the week lower by 1.1% at 10,503.19 on Friday, after recording a record close in the previous week.

Top US Stocks of the Week

Citigroup’s (NYSE: C) shares plunged around 4% on Tuesday despite the bank reporting upbeat Q2 results. Citigroup shares lost around 5% last week.

Shares of JPMorgan Chase (NYSE: JPM) rose slightly on Tuesday, after the company reported its Q2 results higher than the consensus estimates. JPMorgan’s stock climbed 2% last week.

Wells Fargo’s (NYSE: WFC) shares declined by around 5% on Tuesday, after the company reported downbeat quarterly results and announcing plans to cut Q3 dividend. The bank’s shares slipped 2% during the week.

Shares of Goldman Sachs (NYSE: GS) gained over 1% on Wednesday, after the bank posted stronger-than-expected Q2 results.

Morgan Stanley’s (NYSE: MS) stock rose by around 3% on Thursday after the bank reported upbeat quarterly earnings, following a strong uptake in trading and investment banking revenue. The stock gained over 5% last week.

On Thursday, Bank of America’s (NYSE: BAC) shares fell 3% after the company announced plans to increase its loan-loss provisions, despite upbeat quarterly results. Bank of America’s stock lost more than 3% last week.

Shares of Netflix Inc. (NASDAQ: NFLX) plummeted more than 6% on Friday despite the video streaming company reporting better-than-expected quarterly revenue and added a record number of paid subscribers during the quarter. Netflix’s stock lost over 10% for the week.

Performance of European Indices

European stocks finished mixed on Friday, as leaders of the European Union started a two-day meeting to discuss a €750 billion deal for the region’s covid-19 stimulus package. Despite the pressure on Friday, European stocks closed the week with gains.

Rising covid-19 cases and US-China tensions weighed on market sentiment. Concerns were fueled by reports of the US President Donald Trump considering implementing a travel ban on Chinese Communist Party members and their families.

The Stoxx Europe 600 Index rose 0.2% on Friday, gaining 1.6% for the week. The German DAX 30 rose 0.4% on Friday, closing the week higher by 2.3%. The French CAC 40 lost 0.3% on Friday but gaining 2% last week.

Top European Stocks of the Week

Shares of G4S climbed more than 9% on Monday after the security firm announced it might reduce about 1,150 jobs at its cash division.

On Wednesday, ASML Holding’s shares slipped more than 3% after the company posted downbeat Q2 sales.

Shares of Burberry Group fell about 6% on Wednesday after the fashion label reported a 45% decline in sales for the first quarter. The company also projects sales to drop 15%-20% in the second quarter.

On Thursday, Orphan Biovitrum’s shares plummeted 8% after the Swedish company reported Q2 results.

Shares of GVC Holdings lost 4% on Thursday after the British firm reported a decline in Q2 net gaming revenue. The firm also announced the retirement of its CEO.

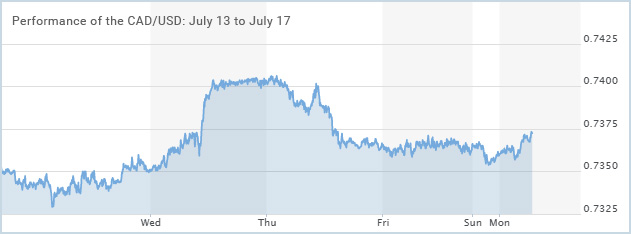

The Forex Market

The Canadian dollar closed mostly flat versus the greenback on Friday, despite a sharp decline in the currency pair on Wednesday. As widely expected, the Bank of Canada kept its key rate unchanged at 0.25%. However, Canada’s central bank projected real GDP to shrink by 7.8% in 2020. The USD/CAD pair, after settling flat on Friday, closed the week slightly lower by 0.1%.

The British pound rose earlier in the week but later pulled back sharply. The sterling found support at the 1.25 level. UK’s unemployment rate came in at 3.9% in the three months to May period, much better than the expectations of 4.2%. The GBP/USD rose slightly on Friday, but closed the week lower by 0.4%.

The Crypto Market

The crypto market finally witnessed some momentum last week following a period of calmness. The movement was, however, on the downside., with Bitcoin prices declining by around 3% over the past seven days, while Ethereum lost more than 5%.

Bitcoin prices traded down close to the $9,100 level over the weekend, continuing its downward movement for the week.

Leave A Comment

You must be logged in to post a comment.