US stocks had started last week on a positive note, with the Nasdaq notching a record close on Monday, as markets enthusiastically awaited quarterly results from major companies. Investors rejoiced positive news related to coronavirus vaccine candidates. AstraZeneca and the University of Oxford announced promising results from their covid-19 vaccine candidate in Phase 1 clinical trials. Meanwhile, BioNTech and Pfizer also said that their vaccine produced antibodies in infected persons participating in the clinical trial in Germany.

The week did not have dearth of good news, as most major companies reported stronger-than-expected results for a quarter that was severely hit by the pandemic.

Despite all the good news, global equity markets have been on tenterhooks, with America falling far behind in the covid-19 fight. Bears flexed their muscles, as the US recorded four consecutive days of 1,000+ deaths due to the novel coronavirus. The country has crossed 4 million infections, with the death toll nearing 150,000. The four hotspots – Arizona, California, New York and Texas – have rolled back reopening measures. Virus-weary Texas is already threatened by Hurricane Hanna, the first Atlantic hurricane this year.

Markets also worried about swiftly deteriorating tensions between US and China, the world’s two largest economies. After Washington ordered Beijing to shut down its Houston consulate, China retaliated by demanding the US to close its consulate in Chengdu.

Even before the bulls could respond to expectations of fresh stimulus by the US government, they were trampled by bearish sentiment being further massaged by downbeat data for initial jobless claims.

Performance of US Indices

US stocks closed lower on Friday with the Nasdaq recording back-to-back losses as investors remained fearful of rising tensions with China and the lack of progress on the new stimulus package.

The Dow Jones Industrial Average slipped 0.7% to close at 26,469.89 on Friday, losing 0.8% for the week. After declining 0.6% on Friday, the S&P 500 index booked 0.3% weekly losses. The Nasdaq Composite Index surged to a record high during the week; but closed the week lower by 1.3% at 10,363.18.

Top US Stocks of the Week

Majesco’s (NASDAQ: MJCO) shares spiked 72% on Monday after the company agreed to be bought by Thoma Bravo for $13.10 a share. The stock gained around 71% last week.

Shares of Philip Morris International Inc. (NYSE: PM) rose more than 4% on Tuesday, after the company reported better-than-expected Q2 results and issuing strong fiscal 2020 earnings guidance. The stock gained over 2% in the week.

Snap Inc’s (NYSE: SNAP) shares fell by 6% on Wednesday, despite the company reporting upbeat earnings and sales for the second quarter. The company’s user growth numbers disappointed investors. The stock lost around 10% last week.

Twitter Inc’s (NYSE: TWTR) stock gained over 4% on Thursday after the company a whopping 34% growth in daily active users in Q2. The social networking company’s stock climbed 5% last week.

Intel Corporation (NASDAQ: INTC) shares nosedived more than 16% on Friday, after the tech giant announced a delay in the launch of its 7-nanometer chips. The stock came under pressure despite better-than-expected quarterly results.

Performance of European Indices

European stocks fell sharply on the last trading day of the week, weighed down by the massive decline in technology stocks. Investors remained worried about the growing political tensions between the US and China.

Markets shrugged off news of the EU leaders agreeing to a massive €1.8 trillion recovery aid to help the countries hardest hit by the pandemic. The French business activity rebounded more than projected in July, with the easing of lockdown measures. The German manufacturing index stabilized, with the PMI rising to 50.0 in July, from a reading of 45.2 in June. The UK retail sales also climbed higher than expected, growing 13.9% in June.

The Stoxx Europe 600 Index dipped 1.68% on Friday, falling 1.5% for the week. The German DAX 30 declined 2%, closing the week lower by 0.6%. After losing 1.5% on Friday, the French CAC 40 posted losses of 2.2% for the week.

Top European Stocks of the Week

Neste’s shares jumped over 11% on Thursday after the Finnish biofuel producer reported a lower-than-expected decline in Q2 profits.

Shares of Publicis Groupe spiked around 8% on Thursday after the advertising company reported better-than-expected quarterly profits.

Centrica’s shares climbed around 17% on Friday after the British gas owner agreed to sell its US energy unit to NRG Energy for $3.6 billion.

Shares of Vodafone plunged more than 5% on Friday after the mobile operator reported a decline in revenues for its fiscal first quarter.

The Forex Market

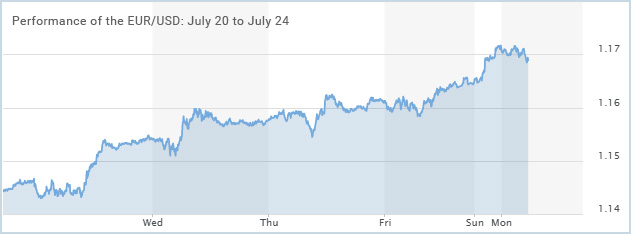

The euro rose for the fifth successive week versus the US dollar, surging towards the 1.1638 level, which marked its highest level since September 2018. The upward momentum in the EUR/USD last week was a combination of encouraging news from the European region, amid growing concerns over tensions between Washington and Beijing and the continuous spike in covid-19 cases. The EUR/USD pair closed the week at $1.1657, gaining 2% during the week.

The Canadian dollar slipped slightly versus the greenback on Friday, but closed the week higher by more than 1%, as the US currency remained under pressure due to some states reinforcing restrictions on economic activities following a rise in coronavirus cases, while US-China dampened sentiment. The USD/CAD pair closed the week at $1.3419.

The Crypto Market

After holding the support level of $9,000, Bitcoin spiked towards $9,600 level last week and then breached the $10,000 mark over the weekend. With investors hedging inflation risks amid governments announcing stimulus packages and easing monetary policy, Bitcoin found favor and maintained above $10,000 this morning.

Ethereum also climbed over the weekend to a new 2020 high of $314 and rose to almost the $330 resistance level today.

Leave A Comment

You must be logged in to post a comment.