Wall Street started the week on a strong note as investors cheered news of encouraging data from late-stage trials of the covid-19 vaccine candidate being developed by Pfizer and BioNTech. The companies disclosed that their vaccine candidate is more than 90% effective in treating patients suffering from coronavirus. The companies also signed deals with various countries for the supply of their vaccines.

Markets were also buoyed by news of Joe Biden’s victory in the US Presidential election with investors expecting faster approval of a new stimulus package. The Wall Street rally took a pause midweek as investors turned their focus to the continued rise in coronavirus cases. The resurgence of cases forced some regions in the US to reinforce tighter social distancing measures.

Cyclical stocks were the major beneficiaries last week as investors expected these to benefit from the highly anticipated economic rebound. There was a sell-off in tech shares, which had been trading at elevated levels during the pandemic.

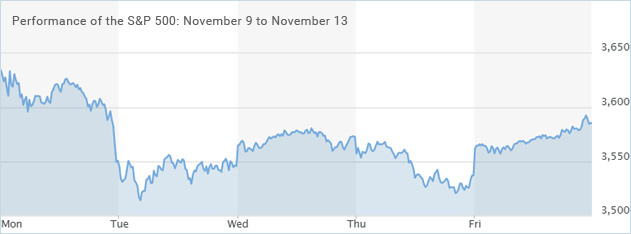

Performance of US Indices

US stocks closed higher on the last trading day of the week, helping the S&P 500 notch a record closing high. The University of Michigan’s consumer sentiment index for November declined to 77, from October’s reading of 81.8, while producer prices increased 0.3% for October.

The Dow Jones Industrial Average jumped around 400 points to close at 29,479.81 on Friday. The blue-chip index climbed over 4% last week, following a 6.9% surge in the prior week. The S&P 500 index surged 1.4% to a record closing high of 3,585.15 on Friday, notching a weekly gain of 2.2%. Although the Nasdaq Composite Index gained 1% on Friday, it closed the week down by 0.55% at 11,829.29.

Top US Stocks of the Week

Shares of Pfizer Inc. (NYSE: PFE) gained around 8% on Monday after the pharma giant released positive results for its coivd-19 vaccine candidate.

BioNTech’s (NASDAQ: BNTX) shares jumped 14% on Monday after the company dislcosed its coronavirus vaccine candidate was 90% effective during the Phase III trial. The stock gained 15% last week.

Shares of Fossil Group, Inc. (NASDAQ: FOSL) gained more than 24% on Thursday after the company reported better-than-expected third-quarter results. The stock added over 31% last week.

Shares of Cisco Systems, Inc. (NASDAQ: CSCO) gained around 7% on Friday after the company posted upbeat Q1 results and issued strong Q2 earnings guidance. The stock added more than 10% in the week.

Walt Disney Co’s (NYSE: DIS) shares gained over 2% on Friday after the company released stronger-than-expected quarterly results. The stock added around 9% last week.

Performance of European Indices

European stocks closed mostly higher on Friday, amid rising optimism over a vaccine for the deadly coronavirus. Upside was limited, however, due to the continuous rise in covid-19 cases.

The Stoxx Europe 600 Index gained 0.01% on Friday and closed the week higher by 5.1%. The German DAX 30 index closed the week higher by around 4.8%. The French CAC 40 added 8.5%, while FTSE 100 rose 6.9% last week.

Top European Stocks of the Week

Shares of Adidas declined around 6% on Tuesday after the company issued a cautious outlook for the fourth quarter.

Shares of URW jumped more than 20% on Tuesday after shareholders of the mall operator rejected the planned rights issue.

ABN Amro’s shares declined around 6% on Wednesday after the Dutch bank reported downbeat net interest income and provided cautious projections.

Shares of Bechtle climbed around 13% on Wednesday after the German company disclosed strong Q3 results.

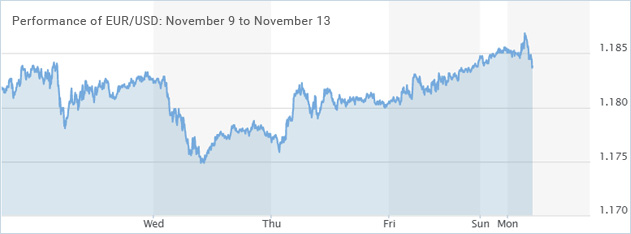

The Forex Market

The euro began last week by rising against the US dollar but soon gave back all gains to settle lower. Markets witnessed intense volatility last week, with the European Union closing its borders due to the resurgence of coronavirus cases. The EUR/USD lost around 0.4% last week.

The greenback continued to gain versus the Canadian dollar, ending the week 0.6% higher. Oil trying to breach the $41 level is expected to lend some support to commodity-related assets this week.

The Crypto Market

Bitcoin jumped to a fresh multi-year high of $16,491 last week, with the digital currency closing above the critical resistance level of $16,000. Bitcoin closed higher for the sixth consecutive week, notching the longest streak since March. The coin traded close to the $16,149 level during the weekend.

Leave A Comment

You must be logged in to post a comment.