Last week started with another encouraging announcement for a covid-19 vaccine after Moderna said that its candidate was 94.5% effective in Phase 3 trials. The update came just a week after Pfizer’s vaccine candidate, developed in partnership with BioNTech, delivered 90% efficacy.

Pfizer managed to stay ahead of Moderna by reporting strong results from the final analysis of its late-stage trial. The efficacy rate increased to 95% in people with and without covid-19 infection in the final analysis. Pfizer and BioNTech also announced the submission of a request to the FDA for EUA (Emergency Use Authorization) of their vaccine candidate.

Meanwhile, coronavirus cases continued to surge around the world, with a seven-day average of new infections rising by 24% week-on-week to 165,029 in the US. On Thursday, the country reported a record 187,833 cases.

Performance of US Indices

Wall Street stocks fell on Friday as investors worried about the continuous rise in covid-19 cases and a delay in Federal Reserve funding for emergency programs casting doubt over the pace of an economic rebound. Several states in the US rolled back plans for reopening, instead announcing new restrictions to contain the spread of the virus.

The Dow Jones Industrial Average lost around 220 points to close at 29,263.48 on Friday. The blue-chip index slipped 0.7% last week following a 4% surge in the prior week. The S&P 500 index declined 0.68% to close at 3,557.54 on Friday, notching a weekly loss of 0.8%. However, the Nasdaq Composite Index received a boost last week as investors bought tech stocks amid renewed to fears of lockdown. Despite falling 0.4% on Friday, the tech-laden index closed the week higher by 0.2% at 11,854.97.

Top US Stocks of the Week

Shares of Tyson Foods, Inc. (NYSE: TSN) rose over 3% on Monday after the company posted better-than-expected quarterly results. However, the stock ended the week 2.5% lower.

Tesla, Inc’s (NASDAQ: TSLA) shares climbed more than 8% on Tuesday following news of the company’s stock being added to the S&P 500 index. Shares of the EV maker jumped around 20% last week.

Walmart (NYSE: WMT) shares fell 2% on Tuesday despite the retailer reporting upbeat quarterly results. The stock lost 0.2% last week.

Shares of Lowe’s Companies, Inc. (NYSE: LOW) plummeted 8% on Wednesday after the company reported downbeat earnings for the third quarter.

Shares of Olema Pharmaceuticals, Inc. (NASDAQ: OLMA) jumped around 158% on Thursday after pricing its IPO at $19 a share.

L Brands, Inc’s (NYSE: LB) shares gained 18% on Thursday after the company reported upbeat results for the latest quarter. The stock added around 16% during the week.

Shares of Hibbett Sports, Inc. (NASDAQ: HIBB) gained 5% on Friday after the company disclosed upbeat Q3 results and issued a strong Q4 forecast. The stock surged around 13% last week.

Performance of European Indices

European stocks closed higher on Friday with markets brushing off news of a continuous surge in coronavirus cases. Investors remained optimistic on encouraging news of a covid-19 vaccine being launched soon by Pfizer and/or Moderna. Direct talks over Brexit have been suspended after a European Union member tested covid-19 positive. However, negotiators continued their respective discussions remotely.

The Stoxx Europe 600 Index added 0.5% on Friday and closed the week higher by 1.2%. The German DAX 30 gained around 0.5% for the week, while the French CAC 40 climbed 2.2% and the FTSE 100 added 0.6%.

Top European Stocks of the Week

Shares of Eurazeo climbed around 6% on Wednesday after the French investment company announced plans to sell its stake in cosmetics firm Iberchem.

Spirax-Sarco’s shares declined around 4% after the company issued a trading update for the third quarter.

Royal Mail’s shares gained more than 3% on Thursday after the company released a strong earnings report.

Shares of Thyssenkrupp declined more than 3% on Thursday after the steel giant released third-quarter results.

Sage Group’s stock plummeted more than 13% on Friday after the British software company reported a plunge in its profit.

The Forex Market

The British pound surged sharply versus the US dollar during the week, climbing above the 1.3250 mark. However, the GBP/USD pair gave up some gains at the end of the week, with investor concerns around the outcome of Brexit talks. The GBP/USD added 0.1% on Friday to close the week higher by 0.6%.

The US dollar recorded gains versus the Japanese yen earlier in the week but found resistance at the ¥105 level. Japan recorded 2,385 new covid-19 cases on Thursday and announced the maximum alert level across the country. Japan’s consumer prices notched the sharpest drop in over 4 years, while the services PMI contracted for the 10th straight month. The USD/JPY lost 0.7% last week.

The Crypto Market

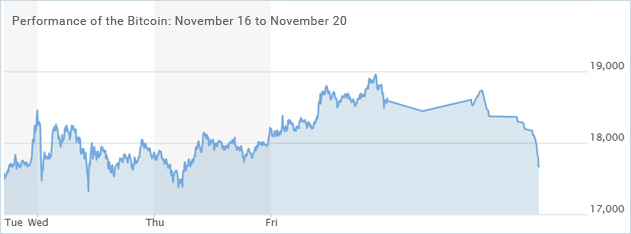

Bitcoin surged to a new 35-month highs above the $18,400 level last week, with the digital currency climbing around 147% for the year and closing the gap to its all-time record high of $19,783. Bitcoin traded close to the $18,443 level during the weekend.

Leave A Comment

You must be logged in to post a comment.