US stocks started off 2021 with a massive downturn on Monday, after ending the previous year on a strong note. Markets turned higher after the slump on prospects of higher government aid with the Democrats winning the Senate race in Georgia.

The Congress also confirmed Joe Biden’s win as the US President last week a day after Trump supporters stormed into the Capitol where lawmakers had gathered to count the Electoral College votes. Trump later promised an "orderly transition" of power on January 20.

Various social networking sites suspended President Donald Trump’s accounts following protests by his supporters.

Performance of US Indices

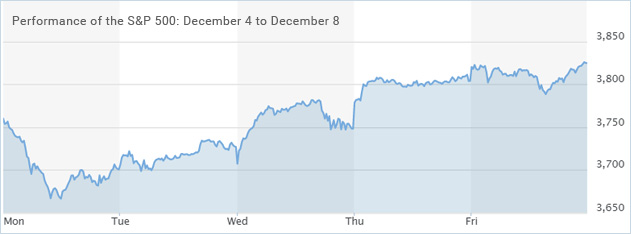

Wall Street closed at record high on Friday despite disappointing jobs data from the US Labor Department. The US economy lost 140,000 jobs in December with a rise in covid-19 cases forcing the government to reimpose stricter measures. Economists had expected a gain of 50,000 jobs in the month. The unemployment rate came in unchanged at 6.7% last month.

The Dow Jones Industrial Average rose 56.84 points to close at 31,097.97 on Friday, adding 1.6% last week. The S&P 500 added 0.55% to reach 3,824.68, recording a gain of 1.8% last week. The tech-laden Nasdaq index rose by 1.03% on the last trading day of the week, surging 2.4% during the week.

Top US Stocks of the Week

Shares of FLIR Systems, Inc. (NASDAQ: FLIR) surged over 19% on Monday after the company agreed to be acquired by Teledyne for $8 billion.

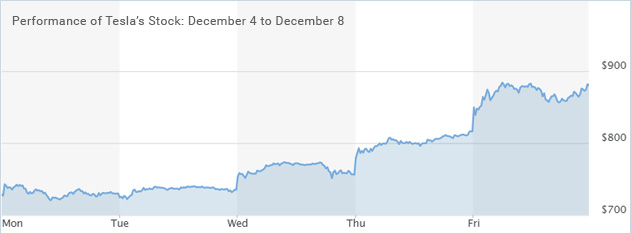

Tesla Inc’s (NASDAQ: TSLA) shares gained more than 3% on Monday after the company reported a 61% year-over-year rise in Q4 deliveries. Shares of the EV maker jumped 25% last week.

Shares of AngioDynamics, Inc. (NASDAQ: ANGO) spiked around 15% on Thursday after the company reported strong quarterly results. The stock surged over 21% during the week.

Bed Bath & Beyond Inc’s (NASDAQ: BBBY) shares dipped around 12% on Thursday after the company posted downbeat Q3 results. However, the stock ended the week around 7% higher.

Shares of WD-40 Company (NASDAQ: WDFC) gained around 12% on Friday following better-than-expected quarterly results. The stock added 13% last week.

Shares of F5 Networks, Inc. (NASDAQ: FFIV) gained over 6% on Friday after the company announced plans to acquire Volterra and raised its sales estimates. The stock surged around 9% during the week.

Performance of European Indices

European stocks closed higher on Friday as investors around the world cheered the US Democratic Party’s win in the Senate race, which is expected to result in higher fiscal support. Encouraging news on covid-19 vaccines also lifted market sentiment as a laboratory study showed that the Pfizer-BioNTech vaccine will prove effective for the new mutations of the coronavirus.

The pan-European Stoxx 600 index rose 0.7% on Friday, recording a weekly gain of 3%, its strongest in about two months. London’s FTSE index closed higher by 0.24% on Friday, recording a surge of 6.4% last week. The German DAX 30 added 2.4%, while the French CAC 40 rose 2.8% last week.

Top European Stocks of the Week

Entain’s shares jumped around 25% on Monday after the company confirmed a takeover bid from MGM Resorts.

Shares of Credit Suisse fell around 4% on Friday after the Swiss lender projected a net loss for the fourth quarter.

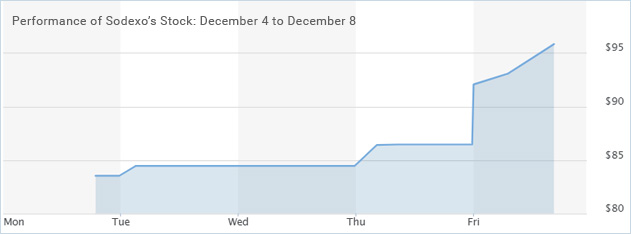

Sodexo’s shares surged around 10% on Friday after the French group posted upbeat results for the latest quarter and raised its forecast.

Shares of Tui plummeted 20% on Friday after the Anglo-German travel operator announced a capital raise worth €545 million.

The Forex Market

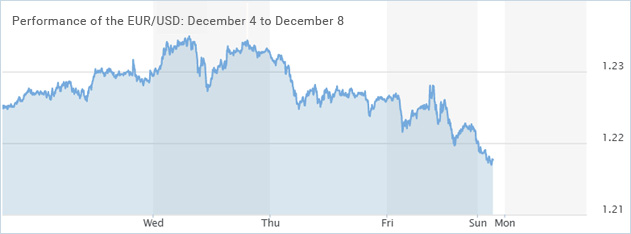

The EUR/USD pair recorded gains during the earlier part of the week, climbing above the 1.23 level. However, the pair pulled back from its highs as the week progressed, amid concerns around rising covid-19 cases and new lockdown restrictions. The EUR/USD pair fell 0.4% on Friday, closing almost flat for the week.

The British pound tried to move higher initially but couldn’t hold gains due to concerns over strict lockdown in the country following the rapid spread of the new strain of covid-19. Markets are now expecting the Bank of England to cut interest rates to the negative zone to provide support to the country’s economy. The GBP/USD pair declined by 0.8% last week.

The Crypto Market

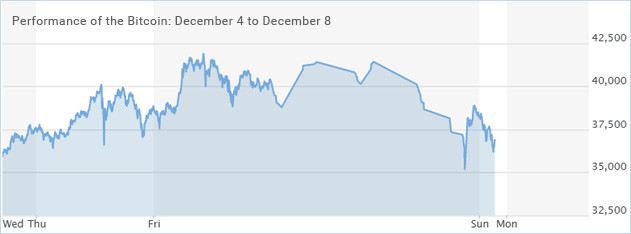

The world’s largest cryptocurrency, Bitcoin, rose sharply to new record highs of $41,530 on Friday, after delivering losses in the previous session, when it declined below the $36,620 level. Bitcoin has skyrocketed around 1,000% since its record low in March 2020.

Ethereum gained around 3% on Friday following a 10% tumble in the prior session. Bitcoin traded lower by around 3% to $38,775 over the weekend, with its rival cryptocurrency, Ethereum, rising 2.8% to $1,222.

Leave A Comment

You must be logged in to post a comment.