For the first time in almost 20 years, the euro has dropped below parity against the US dollar. Many analysts associate this with the exponential rise in interest rates taken on by the Federal Reserve to fight inflation, which is at nearly 40-year highs in the US. While this might spell good news for American travelers to the EU, a weakening euro is likely to not only impact the Eurozone but also the rest of the world. Here’s a look.

Impact on Inflation and Purchasing Power

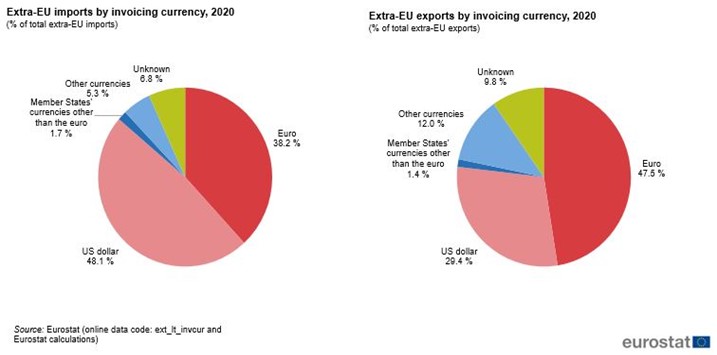

Almost half of the commodities imported by the Eurozone in 2020 were invoiced in the greenback, with less than 40% being invoiced in euros.

Image Source: Eurostat

For instance, gas and oil have always been paid for in USD. Crude oil has seen record high prices in 2022, driven by the supply constraints brought on by the Russia-Ukraine conflict. Although prices have dropped from their peak of $123 per barrel in early March 2022, they continue to hover between $80 and $100. With the euro weakening below the US dollar, citizens of the EU will feel the brunt of high oil and gas prices.

High fuel prices have a direct impact on other goods, which need to be transported from their manufacturing facilities to the markets. The impact of this will be felt by businesses, which will attempt to pass on the increased costs to customers. This could fuel inflation and reduce the purchasing power of households.

On the other hand, European tourism to the US has dampened. Since European visitors have to pay more euros to purchase an equivalent amount in US dollars, their trips to the US have become more expensive. Their trips to countries like Jordan and Qatar, the currencies of which are pegged to the dollar, also cost more now.

Impact on Businesses

The impact of a weak euro on a business will depend on how much it relies on foreign trade and energy. Businesses that export outside the Eurozone are likely to benefit from a decline in the euro’s value. Conversely, import-dependent businesses are likely will to see rising expenses. For example, local craftsmen who depend on energy and raw materials imported from outside the EU but don’t export will find their businesses being adversely affected by the weaker euro.

The export-oriented manufacturing sectors that are likely to benefit from a weak euro are chemicals, luxury goods, automobile and aerospace. Major players from these sectors buy foreign currency in advance at profitable rates to beat the impact of any sharp changes in the exchange rate.

Impact on Growth and Debt

As prices outside the Eurozone become more competitive, due to the drop in the value of the euro, the export of European services and goods abroad will get a boost.

However, this advantageous impact may be mitigated by the increasing prices of goods in the wake of the Russia-Ukraine crisis. This especially applies to export-oriented economies like Germany.

On the other hand, the impact on debt repayment is less explicit. The faster a country experiences economic growth, the sooner it is likely to be able to repay its debt. However, the euro’s weakness increases the cost of debt repayment for countries that need to repay debt in US dollars.

A weak euro adds to the challenges being faced by the European Central Bank (ECB), which has already been facing criticism for raising interest rates much later than other major central banks. The problem now is that the euro’s decline is becoming more broad-based than just against the dollar. The common currency of the EU has also weakened against the Japanese yen and Swiss franc. This adds to the inflation worries for the ECB.

It only remains to be seen how far the euro could drop and its impact on the already pessimistic investor sentiment.

Leave A Comment

You must be logged in to post a comment.