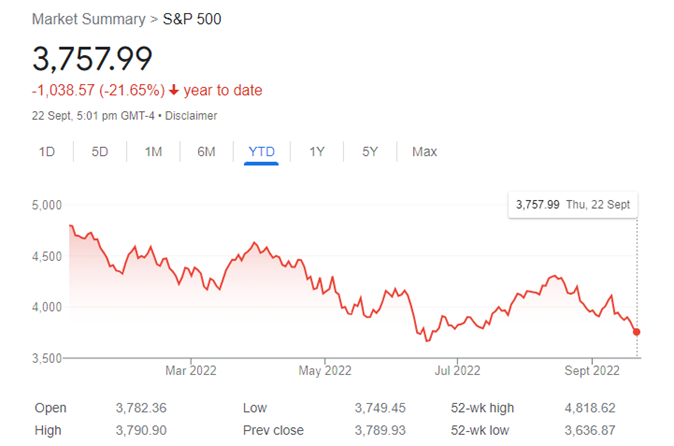

The S&P 500 entered a bear market on June 13, 2022, when the index declined 24.6%. Year-to-date, the index is down 21.65%, as of September 23, 2022. The US stock market has been on a downward trend since the beginning of the year. Any rallies seen so far have been short-lived.

Image Source: Google

A market is generally considered to have entered a bear phase when securities decline 20% or more over an extended timeframe. But the US isn’t the only region to experience a bear market. The German DAX is down 21.95% YTD, while the Hang Seng had dropped 22.81% by September 23, 2022.

The only index that has remained relatively stable is the UK FTSE 100, which has declined only 3.22% YTD.

The downward trend could be because investor sentiment hasn’t been too optimistic through the year. Repeated news of inflation, a potential recession, energy and food supply shortages due to the continuing Russia-Ukraine conflict have all contributed to the bleak outlook. But don’t get lost in all this seeming gloom and doom. Bear markets also offer exciting investment opportunities. Here’s what you need to know.

How to Trade a Bear Market?

The key to trading in a bear market is to focus on sectors that tend to do well during market downturns. For instance, consumer staples, healthcare and utilities will weather any storm because they are indispensable for human beings. Some of the other ways to not just survive but thrive prolonged bear trends are:

1. Focus on Bear Market Rallies

A bear market is characterized by lower highs and lower lows. But it does see short-term rallies through the longer-term downward trend. An upward price move is termed a rally when it rises at least 10% from the recent lows. These rallies offer opportunities for trading before the price reverts to its downward direction. As in any other type of market, the key here is to buy low and sell high.

Image Source: TradingSim

2. Choose When to Short-Sell

It involves selling a security without owning the underlying asset. For instance, if you’re trading stocks, you would sell stocks borrowed from the broker when the price rises and buy them back when the price declines. However, remember that this can be a risky strategy if the market doesn’t move as predicted, or a rally or drop continues for longer than anticipated.

3. Use Stop Losses

Timing is crucial when you trade a bear market, since volatility tends to be higher than that of a bull market. In this scenario, using entry and exit orders can be useful. One of the most popular risk management strategies is using stop-loss orders. These are orders to exit a position when the asset reaches a specific price below the entry price. It helps limit losses. Similarly, a take profit order closes a position at a pre-defined price point above the entry price, locking in profits. This way, if the market reverses, you don’t lose out.

It is important to remember that all investment activities entail risk. Past performance cannot guarantee future returns. Therefore, make sure to conduct your due diligence before investing or trading. And only risk funds that you can afford to lose.

Leave A Comment

You must be logged in to post a comment.