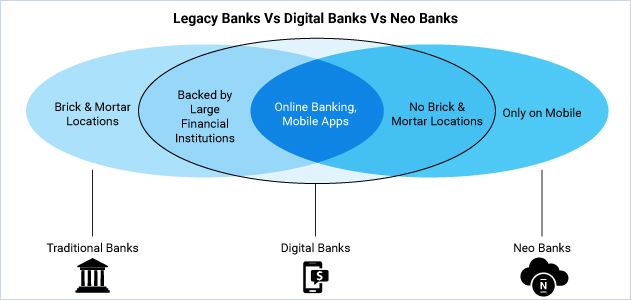

A term that was first used in 2017, neo banks or challenger banks, as they are called in the UK, are living up to their name. These fintech-based banks are giving the traditional banking system quite a run for their money (quite literally). Although neo banks operate only via digital means, such as mobile apps, they aren’t the same as digital banks either.

Digital banks are usually the online subsidiary of an established player in the banking industry, with a physical presence. On the other hand, neo banks exists only in the virtual world, without any physical presence or partnership with traditional banks.

What’s Driving the Neo Bank Wave?

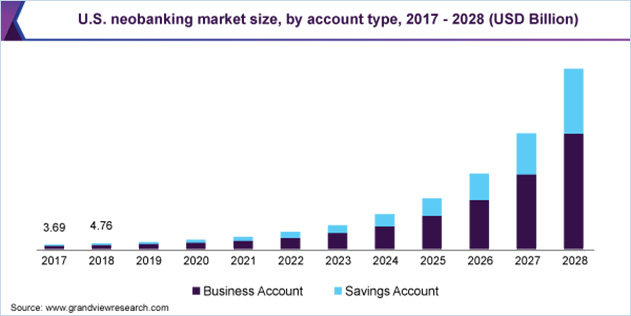

The global neo bank market is expected to be worth $377.94 billion by 2027, from $31.27 billion in 2020, growing at a CAGR of almost 43%. This massive growth will possibly be driven by the online-friendly environment that the pandemic has spurred. The time is just right for the adoption of fintech innovation and the trends that are likely to drive neo banking growth include:

Acceptance of Blockchain Applications

With support from some of the largest financial institutions and large cap companies, blockchain technology is seeing wide acceptance. This is reflected in the meteoric rise in cryptocurrency prices through 2020 and the first quarter of 2021. Blockchain has the power to reduce overhead costs that are usually associated with validation of authenticity, while also helping with business processes, compliance and financial reporting. Some estimates go so far as to claim that this technology could bring down expenses for financial institutions by over 30%.

Rise of Cashless Payments

One of the major changes in consumer preferences has been the move to digital payments and the adoption of innovative payment methods. Digitization and mobility are two primary demands of today’s consumer from the banking sector.

Demand for Mobile Banking

There were 57 million mobile banking users in the US alone, as of March 2021. And, experts forecast that by 2022, 88% of all banking transactions worldwide will be conducted via smartphones.

Artificial Intelligence

While 83% of financial services companies say that AI will determine the future success of their firm, 41% are planning to deploy AI in the new future. Artificial Intelligence has a lot to offer fintech, allowing firms to offer, more advanced and personalized solutions.

Neo Banks Have a Bright Future

Neo banks have significant growth potential, largely driven by the low-cost banking they offer the consumer. With little overheads, these firms are able to give the end user the benefits of very low or even no monthly fees for their services. This makes it attractive not just for millennials but also MSMEs. Some of the other benefits that will spur the growth of neo banks include:

- Ability to offer higher interest rates than traditional banks on savings accounts and fixed deposits.

- Ultra-fast or almost real-time services, including balance checks, payments, account opening, redeeming term deposits, etc.

- Intuitive tools for money management and tracking.

- Simple and engaging UX via mobile apps.

- 24/7 support, powered by AI chatbots.

- High-end security features.

- Low-cost cross-border payments.

- Personalized experiences, including product recommendations and discounts, based on individual spending habits, income, expenses, etc.

- Single platform to link multiple services, accounts, and apps within the neo bank’s ecosystem.

In short, these virtual financial institutions will make financial services and products much more accessible, while easing money management.

There Still are Challenges to Overcome

Like every other sector of the economy, fintech solutions face their own set of challenges. For neo banks in particular, one of the key challenges is that the model might not be attractive to everyone. For instance, neo banks might struggle to engage and garner the trust of customers who prefer in-person conversations and visits to a physical branch.

Another limitation is that these banking firms don’t offer credit facilities. So, no home or car loans, credit cards, etc. While this helps them keep costs significantly low for themselves and the customer, it also limits their product offerings.

Also, the regulatory environment is more difficult to navigate, with stringent requirements, such as AML and validation of authenticity. However, as this fintech segment matures, we could see the regulatory framework also stabilize.

Final Thoughts

The pandemic drove consumers to seek out digital solutions for everyday issues. This led to many neo banks building their customer base quickly and exponentially. However, to be able to sustain this growth and move forward, they will now need to focus on diversifying their offerings.

Many neo banks have done this to great effect, adding insurance, broking and other services to their basket of offerings. The key to future growth now is to shift the focus from the hyper-growth model these banks have been following in recent years to look at a more long-term and sustainable model. The time is ripe for fintech disruption of the traditional banking sector.

Leave A Comment

You must be logged in to post a comment.